Current Trends in Sona BLW Share Price

Introduction

Sona BLW Precision Forgings Limited, a prominent player in the automotive component sector, has been making headlines due to its fluctuating share price in the stock market. Understanding the trends in Sona BLW’s share price is essential for both investors and market analysts, as they reflect the company’s performance, investor sentiment, and broader economic factors influencing the automotive industry.

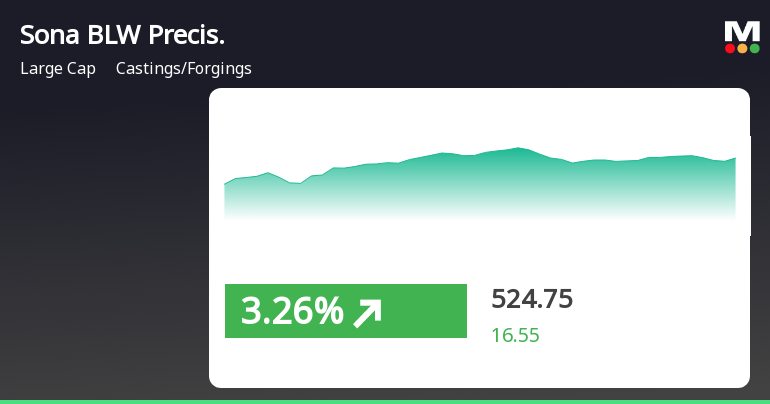

Recent Performance

As of October 2023, Sona BLW shares are showing significant volatility. After a notable peak earlier in the year, the shares experienced a decline owing to various market dynamics, including supply chain disruptions and rising raw material costs. Analysts have reported that as of the last trading session, Sona BLW shares were trading at around ₹450 per share, down from their high of ₹580. This decline has raised concerns among investors regarding the sustainability of the company’s growth trajectory.

Factors Influencing the Share Price

Several factors are contributing to the fluctuations in Sona BLW’s share price. Firstly, the automobile sector’s recovery post-pandemic has been slower than anticipated, leading to reduced forecasts for production and sales. Additionally, global semiconductor shortages have continued to impact vehicle manufacturing, which in turn affects demand for various components supplied by Sona BLW.

Furthermore, recent economic indicators such as inflation rates and changes in government policies pertaining to the automobile sector are influencing investor sentiment. The government’s push for electric vehicles has also positioned Sona BLW to potentially benefit from this transition, but immediate challenges have overshadowed these long-term opportunities.

Market Analyst Outlook

Market analysts remain cautiously optimistic about the future of Sona BLW’s share price. Many suggest that if the company can navigate the current supply chain obstacles and capitalize on the growing electric vehicle market, there is potential for recovery and future growth. Recent strategic moves by the company, including partnerships with technology firms for electric components, have been seen as positive steps.

Conclusion

In conclusion, Sona BLW’s share price remains a focal point for investors looking to capitalize on the automotive sector’s recovery and technological advancements. While short-term volatility poses challenges, the company’s long-term strategies could help in rebuilding investor confidence. As the market continues to evolve, stakeholders will need to stay informed about both global trends and local performance metrics to make educated investment decisions regarding Sona BLW.