Current Trends in Siemens Energy Share Price

Introduction

Siemens Energy, a leading global company in energy technology, has been making headlines recently with fluctuations in its share price. The share price of Siemens Energy is not only a reflection of the company’s financial health but also indicative of trends in the energy sector at large. Investors and market analysts are closely monitoring these movements as they could affect investment decisions and company strategy.

Recent Performance

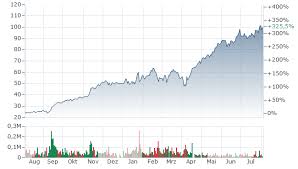

As of October 2023, Siemens Energy’s share price has experienced notable volatility. In recent weeks, the stock traded around €18.50, reflecting a drop of approximately 15% from its earlier highs earlier in the month. Multiple factors have contributed to this decline, including concerns over rising raw material costs and global supply chain disruptions. Additionally, geopolitical tensions and their implications on energy markets have also influenced investor sentiment negatively.

Analysts have pointed to several key events impacting the share price. The recent quarterly earnings report revealed lower-than-expected profits due to increased operational costs, which sparked discussions around the company’s ability to adapt to changing market landscapes. Furthermore, Siemens Energy’s initiatives in renewable energy projects and their long-term effects on profitability are under scrutiny as investors weigh potential gains against current market challenges.

Market Reaction and Analyst Predictions

The market has reacted cautiously, with various investment firms adjusting their ratings for Siemens Energy shares. A recent report from financial analysts at Deutsche Bank suggested a ‘hold’ rating while highlighting the stock’s potential recovery should the company successfully navigate its cost challenges. On the other hand, analysts from UBS have projected that if Siemens Energy can bolster its green technology offerings, there may be significant upside potential, nudging the share price back towards €20 in the next financial quarter.

Conclusion

The Siemens Energy share price serves as a barometer for the company’s operational effectiveness and its response to prevailing market conditions. As the energy sector continues to evolve, stakeholders must remain informed of both macroeconomic developments and the strategic direction Siemens Energy takes. With current uncertainties surrounding costs and global energy demands, investors are advised to stay alert to potential changes in company initiatives and market strategies. While the short-term outlook seems challenging, a focus on sustainable and innovative energy solutions may provide a pathway for long-term value creation for Siemens Energy and its shareholders.