Current Trends in Servotech Share Price: An Overview

Introduction

The Servotech share price has gained increased attention among investors in recent weeks due to its promising growth prospects in the technology and renewable energy sectors. As the company continues to innovate and expand, understanding its share price dynamics is crucial for potential and existing investors.

Recent Performance

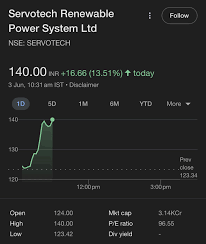

As of October 2023, the Servotech share price has shown significant volatility, fluctuating between ₹120 to ₹145 per share over the past month. This variability reflects the broader market sentiments influenced by global economic conditions and investor confidence in the renewable energy sector. The company recently reported a 25% increase in quarterly revenues, which has positively impacted its stock performance.

Moreover, Servotech’s involvement in cutting-edge technologies such as LED lighting and solar energy solutions has positioned it favorably amidst the growing trend towards sustainable investments. Analysts attribute the recent surge in share price to the rising demand for such technologies, alongside the government’s initiatives to promote renewable energy sources.

Market Reactions and Investor Sentiment

Market reactions to Servotech’s strategic moves and financial disclosures have been largely positive. In a recent survey conducted by a financial news outlet, 65% of investors expressed confidence in the company’s future, citing its consistent performance in expanding its product portfolio and the potential for government contracts in renewable projects.

Institutional investors have also increased their holdings in Servotech, reflecting a bullish outlook on the company’s growth trajectory. The company’s partnership with various utilities to provide energy-efficient solutions has further bolstered investor confidence, contributing to a favorable outlook for the stock.

Conclusion

In conclusion, the Servotech share price represents a compelling opportunity for investors looking to capitalize on the growth in the renewable energy sector. While the stock shows signs of volatility, the underlying fundamentals, including strong revenue growth and strategic partnerships, bode well for its future performance. Investors are advised to keep a close watch on market trends and the company’s developments to make informed decisions. As the global shift towards sustainability continues, Servotech’s position as a key player could lead to substantial long-term gains for investors.