Current Trends in SEPC Share Price: A Detailed Analysis

Introduction

The share price of SEPC (Sambhar Solar Power Limited) has garnered significant attention in the Indian stock market due to its recent performance amidst growing interest in renewable energy investments. As global concern about climate change continues to rise, companies like SEPC that focus on sustainable energy solutions become increasingly relevant. Investors are keenly watching the fluctuations in SEPC’s stock value as they assess the potential for profitable returns.

Recent Performance

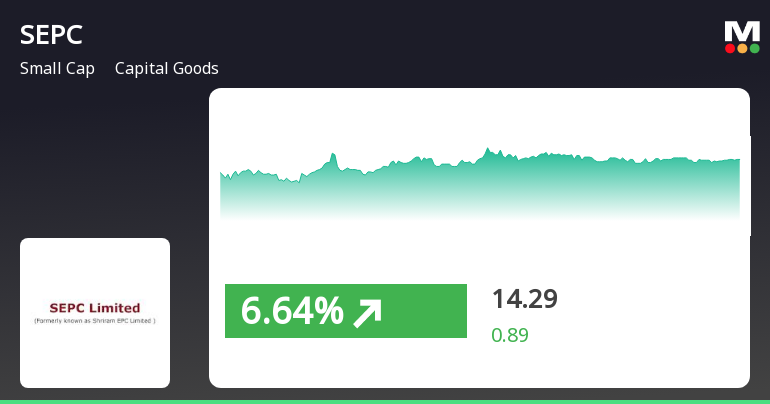

As of the latest trading session, SEPC’s share price closed at ₹123.50, reflecting a notable increase of 3.5% from the previous day. This surge can be attributed to several factors, including a recent contract win for a solar project valued at ₹250 crore and favorable government policies aimed at promoting solar energy. The company’s announcement of an earnings call to discuss its quarterly results has also fueled investor optimism, with many analysts predicting a positive growth trajectory.

According to stock analysts, SEPC has shown resilience despite slight fluctuations earlier in the quarter. The company’s earnings per share (EPS) for the last fiscal year was reported at ₹4.50, a growth of 25% compared to the previous financial year. This performance has solidified SEPC’s position as a key player in the renewable energy sector, with expectations of further growth supported by government incentives.

Market Sentiment

The broader market sentiment towards renewable energy stocks remains optimistic, largely driven by global policies aimed at reducing carbon emissions. SEPC, in particular, is well-positioned to capitalize on this trend. Analysts have noted an increase in institutional investment in solar energy stocks, with SEPC receiving interest from major financial institutions. This kind of backing typically indicates confidence in the company’s long-term growth potential.

Conclusion

In summary, SEPC’s share price performance reflects a combination of favorable contracts, strong earnings, and positive market sentiment regarding renewable energy investments. As investors watch closely, SEPC appears poised for continued growth in the coming quarters. However, potential investors should remain vigilant about market dynamics and global economic factors that could affect stock prices. Overall, SEPC presents a compelling case for those looking to invest in the renewable energy sector, aligning financial goals with sustainable initiatives.