Current Trends in Senco Gold Share Price

Introduction

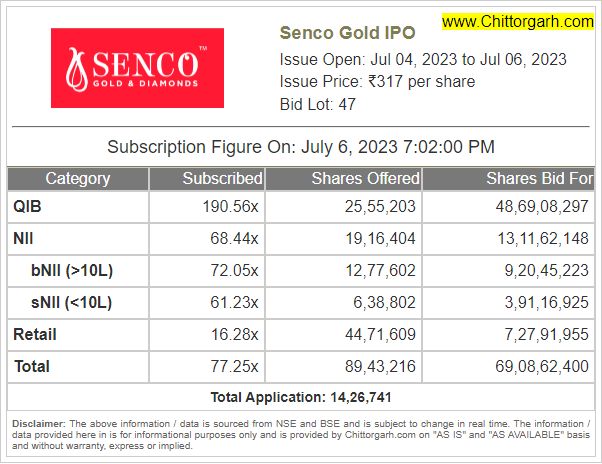

In recent months, the Senco Gold share price has become a focal point for investors in the Indian stock market. Senco Gold Jewellers, a prominent player in the gold and diamond jewelry sector, has seen significant fluctuations in its share price, reflecting wider trends in the economy, investor sentiment, and the ongoing impact of global gold prices. Understanding these trends is crucial for potential investors and market analysts alike.

Recent Trends in Senco Gold Share Price

As of October 2023, Senco Gold’s share price has shown a notable upward trend after experiencing volatility earlier in the year. The stock opened at ₹486.50 per share on the Bombay Stock Exchange and climbed to ₹520.75, an increase of about 7% over the last month. Analysts attribute this rise to increased consumer spending during the festive season, which has historically boosted gold sales in India.

Additionally, Senco Gold announced a successful first quarter with an impressive 20% increase in revenue compared to the previous year, further enhancing investor confidence. The company’s robust growth strategy, including expanding its online presence and launching new product lines, has positively influenced its market performance.

Market Influences

The fluctuations in the Senco Gold share price can also be attributed to global gold prices, which have been on a roller-coaster ride due to changing geopolitical tensions and inflation rates. As gold is often seen as a safe-haven asset, its price usually influences jewelry companies significantly. For instance, when gold prices surge, it typically leads to an increased cost for consumers, which may dampen demand for gold products. Conversely, when gold prices stabilize or decrease, consumer purchases often increase, benefiting retail jewellers like Senco Gold.

Conclusion

In conclusion, the performance of Senco Gold’s share price is not only a reflection of the company’s internal strategies but also of broader economic factors. Investors looking to capitalize on the gold jewelry market should keep a close eye on Senco Gold’s price movements, as they can be indicative of emerging trends within the industry. Analysts predict that if current trends continue, Senco Gold could see further gains by the end of the financial year, making it a stock worth monitoring for potential investment opportunities.