Current Trends in Reliance Infra Share Price and Market Insights

Introduction

Reliance Infrastructure Limited (Reliance Infra) is a key player in India’s infrastructure sector, with interests spanning power, roads, and metro rail. Understanding the fluctuations in its share price is crucial for investors and stakeholders, especially in an evolving economic landscape. As of late 2023, the stock market has witnessed various impacts from global economic conditions, government policies, and sector-specific developments, making it essential to keep an eye on the trends surrounding Reliance Infra’s stock performance.

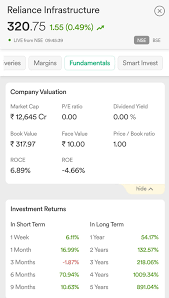

Current Share Price Performance

As of October 2023, Reliance Infra’s share price has shown noticeable volatility. The stock was trading around ₹78 per share, reflecting a significant increase compared to earlier this year when it hovered around ₹60. This upward trend can be attributed to several factors, including positive quarterly earnings and strategic announcements regarding project expansions.

Key Factors Influencing Share Price

- Quarterly Earnings: In its latest report, Reliance Infra announced a 12% year-on-year increase in revenue, which boosted investor confidence.

- Government Initiatives: The Indian government’s focus on infrastructure development and increased allocations for road and transportation projects has benefitted firms like Reliance Infra.

- Market Sentiment: Broader market trends and investor sentiment also play a significant role. A bullish outlook on the overall market has translated into increased trading in Reliance Infra shares.

Recent Developments

Reliance Infra has been actively expanding its project portfolio. Recently, the company secured a substantial contract to build a new expressway, further solidifying its position in the infrastructure sector. Additionally, the company has shown interest in renewable energy projects, aligning with the global shift towards sustainable energy solutions.

Investment Outlook

Investors looking at Reliance Infra should consider both the short-term and long-term potential that the company presents. With ongoing infrastructure projects and expanding operations, analysts believe that the share price may continue to rise in the coming months. However, as with any investment, there are risks involved, especially concerning regulatory changes and global economic conditions.

Conclusion

In conclusion, the Reliance Infra share price is experiencing positive momentum, driven by strong earnings, strategic projects, and favorable government policies. Investors should keep a close watch on market trends and company developments to make informed decisions. As India’s infrastructure landscape continues to grow, Reliance Infra is likely to remain a focal point for investors seeking opportunities in this vital sector.