Current Trends in Reliance Industries Share Price

Introduction

Reliance Industries Limited (RIL), one of India’s largest conglomerates, has significant impact on the stock markets. The performance of its share price is often seen as a barometer for the broader economic environment in India. With diverse interests spanning petrochemicals, telecommunications, and retail, fluctuations in RIL’s stock are of utmost importance to investors and market analysts alike.

Recent Performance

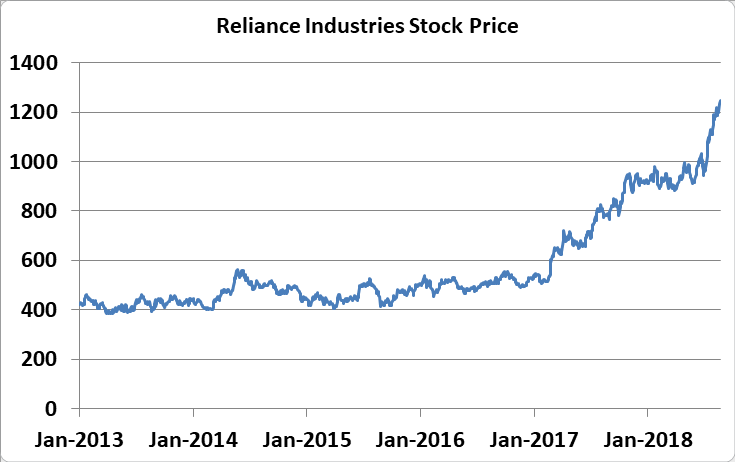

As of October 2023, Reliance’s share price has experienced considerable volatility. After hitting an all-time high earlier this year, shares have seen a gradual decline alongside global market trends influenced by fears of rising interest rates and economic slowdowns. Analysts suggest that the current price hovering around INR 2,500 is a crucial level for investors, who are watching to see if it can hold steady or rebound.

Factors Influencing Share Price

Several factors contribute to the latest trends in Reliance Industries’ share price. Primarily, the company’s quarterly earnings reports have shown strong revenue streams, particularly from its telecom and digital service sectors. The recent announcement regarding increased investments in green energy projects has also captured investor interest, leading to short-term rallies in share price despite market headwinds.

Market Analysis and Expert Opinions

Market analysts suggest that RIL’s share price is likely to remain under pressure in the short term due to macroeconomic factors and geopolitical tensions. However, long-term analysts remain optimistic, stating that the foundational strength of Reliance’s diversified business model and aggressive investment strategy in renewable energy could lead to significant price appreciation over the next few years. Moreover, if the company manages to successfully capitalize on emerging digital trends, the fundamentals could very well shift in favor of RIL’s stock.

Conclusion

For investors, the Reliance Industries share price is not only a reflection of corporate performance but also a signal of potential market shifts. Staying informed about economic indicators and company developments is key for navigating this dynamic landscape. While currently facing challenges, the future of Reliance Industries may well rely on its strategic direction and adaptability in a changing market environment. Investors are encouraged to keep a close watch on these aspects as they decide on their investment strategies.