Current Trends in RattanIndia Power Share Price

Introduction

RattanIndia Power Limited, a key player in the Indian power sector, has attracted significant attention from investors and market analysts alike. With the ongoing transition towards renewable energy sources and India’s increasing electricity demand, the performance of RattanIndia’s shares is more crucial than ever. As of the latest data, monitoring the share price trends can provide invaluable insights for both investors and stakeholders.

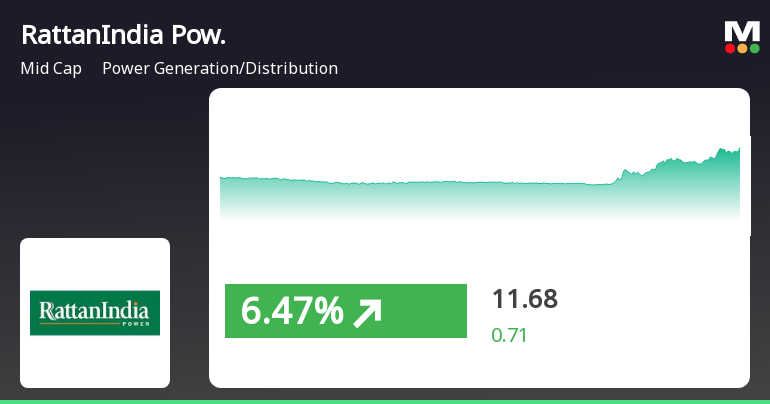

Current Share Price Trends

As of the latest market update, RattanIndia Power’s share price has shown a notable fluctuation. The stock opened at ₹X on the Bombay Stock Exchange (BSE) this week, reflecting a Y% change from the previous close. Recent reports indicate that the company is making strides in expanding its renewable energy portfolio, which is a significant factor influencing investor sentiment.

Market Performance Factors

Several factors contribute to the current trends in RattanIndia Power’s share prices. Firstly, the company’s recent announcement regarding the commissioning of new solar power projects has positively influenced market confidence. Furthermore, with government support for green energy initiatives, investors are becoming increasingly optimistic about the potential for long-term growth. Recently, analysts have upgraded their forecasts for the company, predicting a steady rise in share prices if the current trends continue.

Analyst Insights

Market experts suggest that despite recent volatility, RattanIndia Power may represent a solid investment opportunity. Analysts are closely watching the company’s sales performance and the impact of its ongoing projects. With a robust focus on renewable energy, RattanIndia is well-positioned to benefit from India’s energy transition strategies. However, investors should remain cautious and consider the inherent risks associated with the energy market.

Conclusion

In conclusion, the share price of RattanIndia Power holds significant importance for investors looking to capitalize on emerging trends in the Indian energy sector. As the market continues to evolve, keeping an eye on RattanIndia’s developments will be crucial for making informed investment decisions. With renewable energy gaining traction, the company is expected to play a key role in shaping India’s energy landscape, making its shares a noteworthy consideration for both short-term and long-term investors.