Current Trends in Protean Share Price

Introduction

In recent months, the fluctuation of the Protean share price has drawn significant attention from investors and market analysts. Understanding these trends is crucial for stakeholders considering investment in the company’s future. As Protean continues to expand its operations in the digital payments sector, the share price not only reflects market sentiment but also the company’s growth prospects.

Recent Trends and Performance

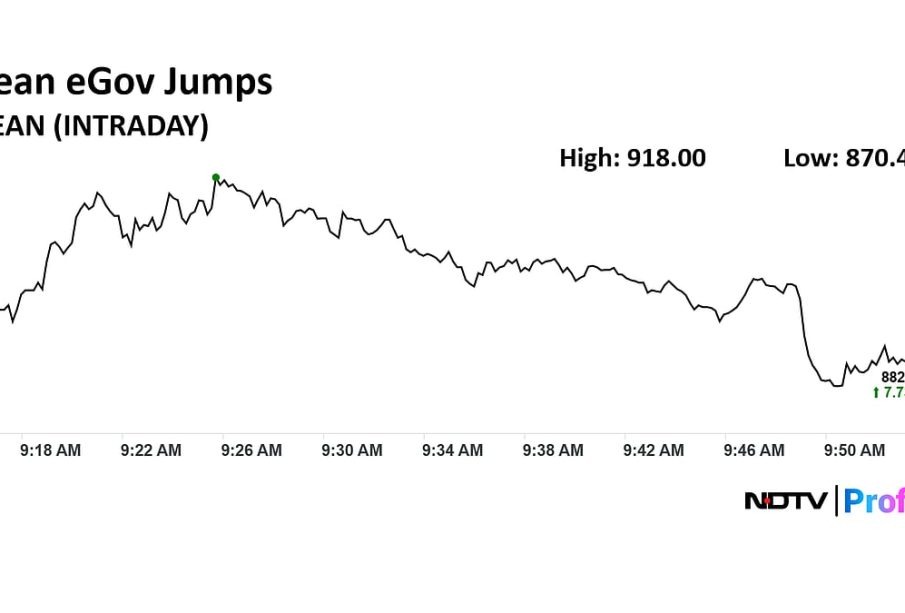

As of October 2023, the Protean share price has exhibited notable volatility, with its value fluctuating between ₹300 and ₹450 over the past quarter. One of the significant factors contributing to this fluctuation is the company’s ongoing efforts to enhance its technology infrastructure and expand its service offerings. Recently, Protean has entered into several strategic partnerships with fintech companies which have positively influenced investor confidence.

Moreover, the overall market conditions, including the performance of the Nifty 50 and other financial indices, have impacted the share price. Analysts indicate that the increasing competition in the digital payment space has led to heightened scrutiny of companies like Protean, thus affecting its share price dynamics.

Key Events Impacting Share Price

Several key events have played a role in shaping the current share price. In September 2023, Protean reported a significant increase in quarterly revenues, attributing this growth to the expansion of its digital payment services and improved customer engagement strategies. This news led to a brief surge in the stock price, encouraging bullish sentiment among traders.

Furthermore, the company announced initiatives aimed at enhancing user experience and adopting advanced technology, such as AI-driven analytics, which are expected to attract more users to its platform. These developments could play a pivotal role in stabilizing and potentially increasing the Protean share price in the coming months.

Conclusion

In conclusion, the Protean share price remains a topic of interest as it is influenced by various internal and external factors. The company’s strategic initiatives and the broader market conditions will play a significant role in determining its future trajectory. For investors, staying updated on company announcements and market trends is essential in making informed decisions. As Protean strengthens its position in the digital payments sector, potential long-term investors may find value in closely monitoring the share price movement over the upcoming quarters.