Current Trends in Power Grid Share Price for 2023

Importance of Power Grid Share Price

The power sector plays a critical role in India’s economy, and Power Grid Corporation of India Limited (PGCIL) is a vital entity ensuring efficient transmission of electricity across the country. As one of the largest power transmission companies in India, the share price of Power Grid is of significant interest to investors, analysts, and stakeholders in the energy sector. Understanding its movements not only provides insights into the company’s performance but also reflects the overall state of the energy market in India.

Recent Trends and Performance

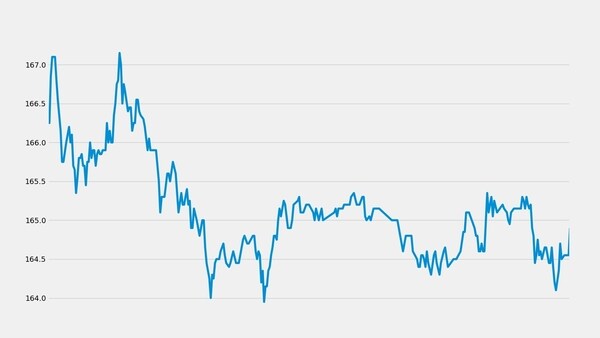

As of October 2023, Power Grid’s share price has shown remarkable resilience and growth, reflecting positive market sentiment towards the Indian power sector. Over the past month, the share price has increased by approximately 5%, driven by strong quarterly results that exceeded analysts’ expectations. Specifically, for Q2 FY2023, PGCIL reported a revenue growth of 10%, attributed to an increase in the volume of electricity transmitted and the commissioning of new projects.

Analysts have credited the government’s focus on renewable energy initiatives as a key factor supporting Power Grid’s positive performance. Initiatives like the National Electricity Plan and the push towards expanding renewable energy sources have led to increased investments in power infrastructure, directly benefiting companies like PGCIL.

Factors Influencing Share Price

Several factors play a role in determining the share price of Power Grid, including macroeconomic stability, regulatory frameworks, and energy demand forecasts. The recent rise in coal prices globally has had implications for energy production costs; however, PGCIL, primarily involved in transmission, remains somewhat insulated from these fluctuations.

Another important aspect affecting the share price is the company’s strategic expansions. Power Grid continues to invest in diversifying its portfolio and enhancing its transmission capabilities, which has vital implications for its share outlook. Collaborations with private players and international investments are also expected to provide long-term growth prospects.

Conclusion and Future Outlook

Looking ahead, industry experts predict a tempered but steady growth for Power Grid’s share price as demand for electricity is projected to rise with urbanization and economic growth in India. The implementation of efficient technologies in power distribution and transmission is likely to yield additional operational efficiencies, further enhancing profitability.

For investors, Power Grid remains an attractive investment option, given its pivotal role in supporting India’s energy infrastructure. Continuous monitoring of regulatory changes, market trends, and global energy prices will be essential for stakeholders looking to maximize their investments in power sector equities.