Current Trends in Polycab Share Price

Importance of Polycab Share Price

The share price of Polycab India Limited, a leading manufacturer of electrical wires and cables, is of great importance to investors and market analysts alike. This stock has shown significant growth over the past few years, reflecting the company’s strong position in the market and its proactive business strategies. As Polycab continues to expand its product range and market reach, understanding its share price trends is crucial for potential investors.

Recent Performance of Polycab Shares

As of late October 2023, Polycab’s share price has been a subject of much interest among stock market enthusiasts. The shares have recently showed a rising trend, reaching a new high of approximately ₹2,030 per share, a notable increase from ₹1,850 in early September 2023. Analysts attribute this upward surge to various factors, including enhanced sales, strong quarterly earnings, and positive market sentiment surrounding the country’s robust infrastructure development initiatives.

Quarterly Earnings Report

Polycab’s latest quarterly earnings report, released earlier this month, indicated a 15% increase in year-on-year sales, with profit margins also on the rise. With increasing demand for electrical wiring as the construction industry booms, Polycab is well-positioned to capitalize on this trend. This positive earnings outlook has also played a pivotal role in boosting investor confidence and, in turn, the share price.

Market Influencers

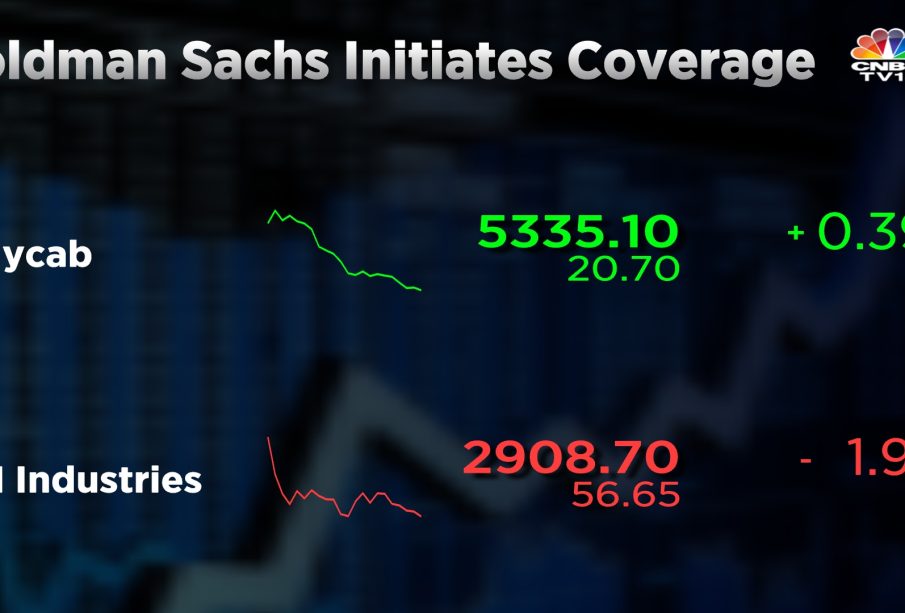

Key market influencers such as analysts’ ratings and macroeconomic factors are also affecting Polycab’s share price. Recent reports suggest that several brokerage houses have upgraded their ratings on Polycab, which has fueled additional buying interest from institutional investors. Furthermore, the stability in raw material costs has bolstered Polycab’s production efficiency, further positively impacting the share price.

Forecast and Significance for Investors

Looking ahead, analysts foresee continued growth in Polycab’s share price, driven by ongoing investments in infrastructure and the government’s push for sustainable energy solutions. It is projected that if the growth momentum continues, Polycab could see its share prices cross the ₹2,200 mark by the end of this fiscal year.

For current and prospective investors, monitoring the performance of Polycab shares is paramount. With its strong market fundamentals and growth potential, Polycab remains a compelling choice for those looking to invest in the electrical manufacturing sector. Overall, the share price trends reflect the company’s robust operational health and market adaptability, making it a significant player in India’s burgeoning economy.