Current Trends in PNB Share Price and Market Analysis

Introduction

Punjab National Bank (PNB) is one of India’s largest public sector banks and serves millions of customers across the country. The bank’s share price is a crucial indicator of its performance and is closely monitored by investors and market analysts. Recent fluctuations in the share price can significantly affect investment strategies and market sentiment, making it essential to stay informed about these trends.

Recent Trends in PNB Share Price

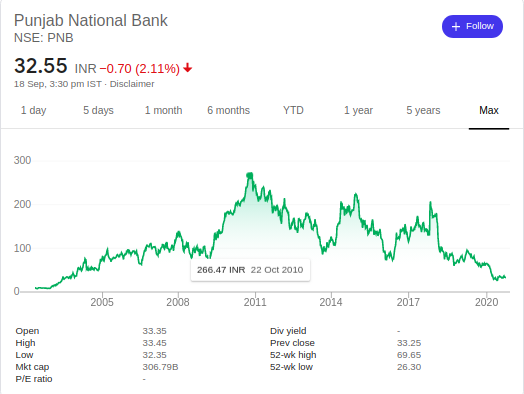

As of October 2023, PNB’s share price has shown considerable volatility. After closing at ₹60 per share at the end of September, it has experienced both highs and lows, influenced by broader economic factors and banking sector performance. On October 15, the shares rallied to a high of ₹65 amid positive quarterly earnings reports and a general uptick in the banking sector.

One of the significant factors impacting the share price has been the bank’s continued focus on reducing non-performing assets (NPAs) and improving the asset quality. This move has been well received by investors, contributing to a slight appreciation in share value over the past month. Furthermore, positive reviews from credit rating agencies have buoyed investor confidence, leading to increased trading volumes for PNB shares.

Factors Influencing PNB’s Share Price

Several key factors are affecting the share price of PNB. These include:

- Macroeconomic Conditions: The Indian economy’s recovery from the pandemic, along with government policies aimed at boosting growth, plays a crucial role in influencing the banking sector’s performance.

- Bank’s Financial Health: Quarterly financial results, investor sentiment about NPAs, and capital adequacy ratios are vital indicators that investors consider while evaluating the stock.

- Sectorial Trends: The overall performance of the banking sector, competitive landscape, and regulatory changes can affect PNB’s share price significantly.

Conclusion

In conclusion, keeping track of PNB’s share price is essential for investors interested in the banking sector. With continuous efforts towards improving its financial position and the overall positive market outlook, PNB’s stock could present various opportunities for investors in the coming months. Market analysts predict that if the bank maintains its course, the share price may see further appreciation in response to favorable economic conditions and improved financial performance.