Current Trends in PNB Share Price: An Overview

Introduction

The Punjab National Bank (PNB) is one of India’s oldest and largest public sector banks, making its share price a significant indicator for both investors and the banking sector’s stability. As of October 2023, the performance of PNB shares is being closely monitored due to various economic factors that could influence its trajectory on the stock market.

Current Market Performance

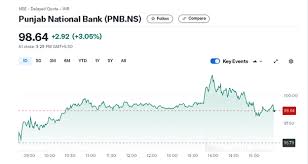

As of the end of October 2023, PNB’s share price has experienced fluctuations, primarily responding to macroeconomic conditions, regulatory changes, and overall investor sentiment towards public sector banks. The share price of PNB stood at approximately ₹55, marking a notable increase from previous months, attributed to improved financial results and a strong loan recovery process. Analysts observed a rising trend after the bank reported a decrease in its NPAs (Non-Performing Assets), reflecting effective management practices.

Factors Influencing PNB Share Price

Several factors contribute to the current state of PNB’s share price, including:

- Macro-Economic Indicators: The Indian economy is on a recovery path post-pandemic, influencing overall banking performance.

- Bank’s Financial Health: Recent quarterly results presented a growth in net profit, a key factor impacting investor confidence.

- Government Policies: Announcements related to public sector reforms can drive interest in PNB shares.

- Market Sentiment: Investors’ perception of the banking sector’s stability significantly influences PNB’s market movements.

Future Outlook

Looking ahead, financial analysts predict that the PNB share price will remain volatile but may show upward momentum as long as the economic recovery continues and the bank maintains its trajectory toward better asset quality and profitability. Prospective investors are advised to keep a close watch on economic indicators and PNB’s operational performance for any strategic adjustments that could impact share price.

Conclusion

In conclusion, the PNB share price reflects a composite of several influencing factors, including economic health, regulatory landscapes, and the bank’s performance metrics. For investors, monitoring these dynamics is crucial for making informed decisions. With a historical presence in India’s banking system, PNB stands as a critical entity, and its share price will be a significant aspect to watch in the coming months.