Current Trends in Paytm Share Price: An In-Depth Analysis

Introduction

The share price of One97 Communications Limited, which operates the popular digital payment platform Paytm, has been a significant topic of discussion among investors and market analysts. As digital payments continue to grow in India, understanding the dynamics that influence Paytm’s stock price is crucial for potential investors.

Recent Trends

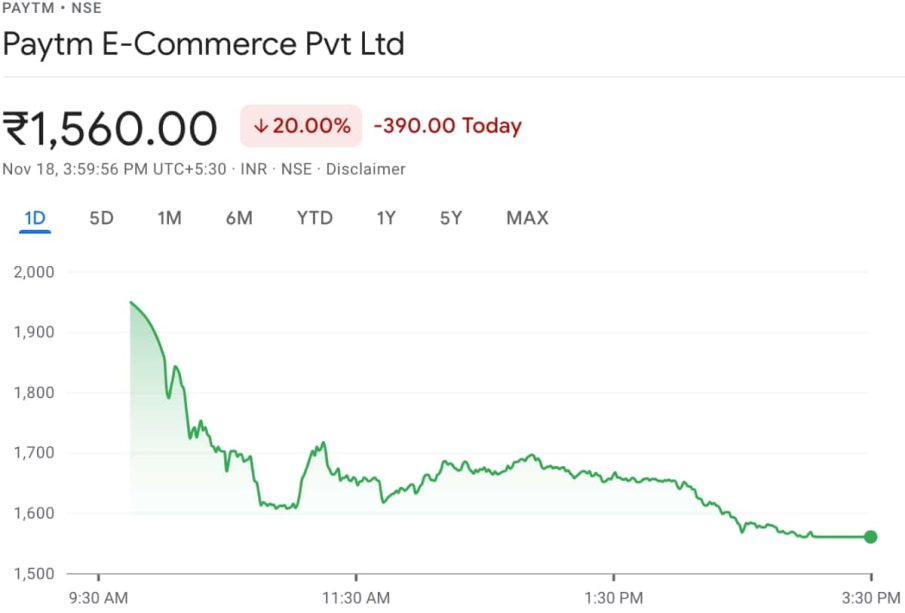

As of October 2023, Paytm’s share price has shown noteworthy volatility. After its initial public offering (IPO) in November 2021, where it was priced at ₹2,150 per share, it experienced a steep decline, reaching an all-time low of around ₹500 in early 2022. However, the stock began to recover due to several factors, including increased adoption of its payment services and strategic partnerships.

Recent financial results indicate that Paytm’s revenue has grown significantly, owing to a rise in its gross merchandise value (GMV), which surpassed ₹2 trillion in the last quarter. Consequently, as of October 2023, Paytm’s share price has rebounded to approximately ₹800, reflecting a growing confidence among investors.

Market Influences and Future Outlook

Several factors are influencing Paytm’s current share price, including increasing competition in the digital payments space, regulatory developments, and the overall performance of the Indian stock market. Analysts point to the company’s expansion in financial services—such as insurance and lending—as a critical driver for long-term growth. Additionally, as more consumers embrace digital transactions, Paytm is strategically positioned to capitalize on this trend.

Industry experts predict that Paytm’s focus on technology enhancements and customer experience improvements will positively impact its stock performance. If the company’s earnings continue to meet or exceed expectations in upcoming quarters, it could signal a bullish trend moving forward.

Conclusion

In conclusion, the fluctuations in Paytm’s share price are reflective of broader market trends and specific business developments. For investors, keeping an eye on Paytm’s financial releases and market positioning will be key to making informed investment decisions. With the digital payment landscape evolving rapidly, Paytm’s ability to adapt and innovate will significantly determine its stock performance in the coming months.