Current Trends in NTPC Green Share Price and Market Impact

Introduction

The green energy sector is gaining momentum worldwide, and as a key player, NTPC Limited is making significant strides in renewable energy production. Recent developments in NTPC’s green initiatives have attracted both investor and market attention, making the NTPC green share price a critical topic for investors and stakeholders.

Recent Developments in NTPC

NTPC, India’s largest power utility, has been active in transitioning towards a sustainable future by expanding its renewable energy capacity. As of October 2023, the company aims to increase its renewable energy capacity to 60 GW by 2032, which is a substantial leap considering its current mix of generation sources. This ambition aligns with India’s commitment to increasing renewable energy generation, looking to achieve 500 GW by 2030.

The implementation of various projects, including solar photovoltaic (PV) installations and wind energy farms, is underway. Recently, NTPC announced that it would be investing in developing a 1 GW solar power plant in Rajasthan, which is expected to further bolster its green share price.

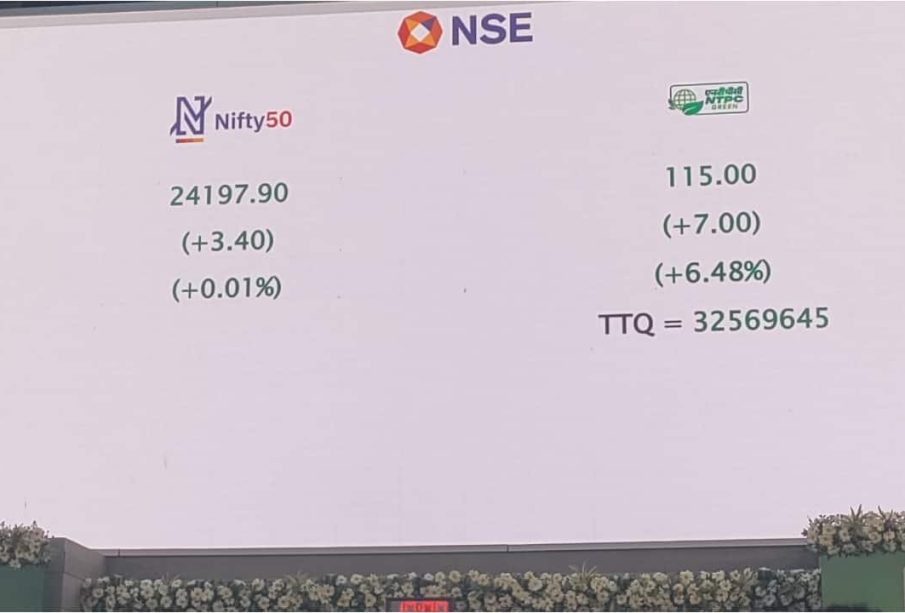

Market Performance and Share Price Trends

The share price of NTPC Green has shown a notable upward trend in recent months. As of mid-October 2023, NTPC’s stock was trading at around INR 200 per share, showing a significant rise compared to earlier this year. Analysts attribute this rise to the government’s push towards green energy and NTPC’s innovative strategies to boost its renewable energy portfolio.

Factors contributing to the positive sentiment around NTPC’s share price include government support for renewable energy, growing investor interest in ESG (Environmental, Social, and Governance) compliant companies, and NTPC’s robust financial performance.

Conclusion

As the energy landscape shifts towards sustainability, NTPC’s focus on renewable energy is likely to enhance its market position, positively influencing the NTPC green share price in the long term. Investors and market analysts are advised to keep a close eye on NTPC’s upcoming initiatives and government policies affecting renewable energy to better understand the potential for further share price appreciation. Overall, NTPC’s commitment to green energy not only aligns with global sustainability goals but also presents a promising opportunity for investors looking to engage with environmentally responsible companies.