Current Trends in Nippon Silver ETF Share Price

Introduction

As investors continuously seek safe-haven assets amidst fluctuating market conditions, the Nippon Silver ETF, a popular exchange-traded fund in India, has become a key focal point. Tracking the performance of silver, this ETF offers market participants a convenient way to access this precious metal with the potential for significant returns. Understanding its share price movements is essential for potential investors and market analysts alike.

Overview of Nippon Silver ETF

Nippon Silver ETF is managed by Nippon Life India Asset Management. It aims to replicate the performance of silver bullion and serves as a hedge against inflation and currency fluctuations. With rising uncertainties in global markets, the demand for silver has seen a notable uptick, consequently influencing the ETF’s share price.

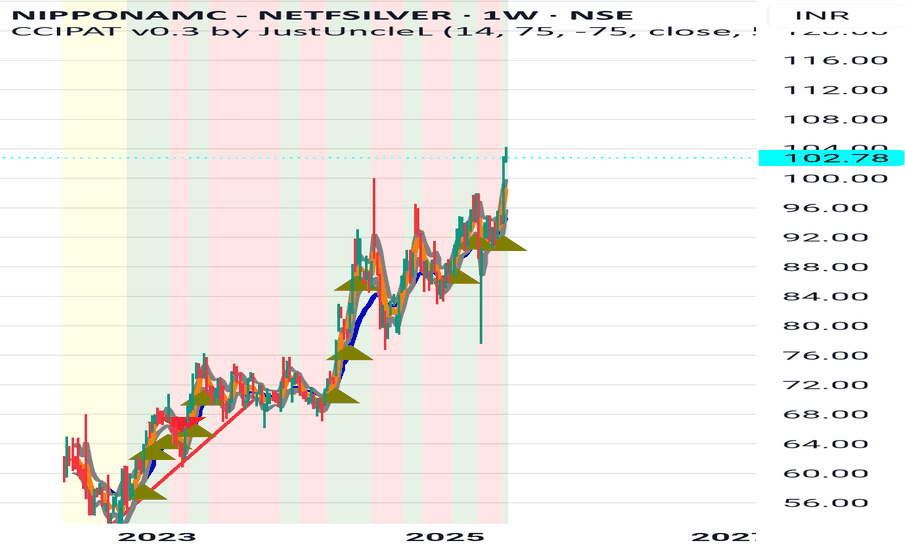

Current Share Price and Market Trends

As of the latest trading session on September 29, 2023, the Nippon Silver ETF was priced at ₹617, witnessing an increase of 1.5% over the previous week. Market analysts attribute this uptick to growing investor interest in silver, driven by geopolitical tensions and inflationary pressures affecting global economies. Additionally, the silver market has been bolstered by increased industrial demand and a weak U.S. dollar, which makes silver cheaper for foreign investors.

Performance Factors

The performance of the Nippon Silver ETF is influenced by various factors, including global silver prices, currency fluctuations, and economic events. Recent data from the Indian Bullion and Jewellers Association (IBJA) indicates that silver prices have risen by approximately 7% in the last month, reflecting strong global demand. Furthermore, the ETF’s liquidity and trading volume have performed well, indicating healthy investor participation.

Conclusion

With its current positive momentum, the Nippon Silver ETF presents a viable investment opportunity for those looking to diversify their portfolios with precious metals. Given the ongoing economic uncertainties and the favorable trends in the precious metals market, the ETF’s share price may continue to rise in the short to medium term. Investors are advised to keep an eye on market developments and economic indicators that could impact silver prices in the upcoming months.