Current Trends in Nifty 50 Share Price

Introduction

The Nifty 50 index, a key benchmark for the Indian stock market, represents the performance of the top 50 companies listed on the National Stock Exchange (NSE). Understanding the Nifty 50 share price is crucial for investors as it is a barometer of market health, economic trends, and investor sentiment. Tracking its movements helps both seasoned investors and those new to the market make informed decisions.

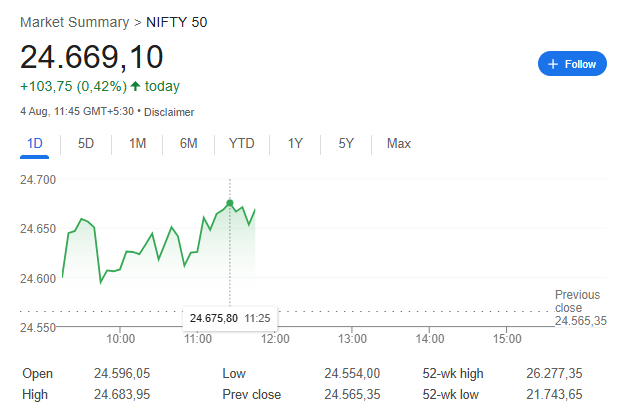

Current Market Performance

As of October 2023, the Nifty 50 index has shown considerable volatility, reflecting changes in global economic conditions and domestic investor sentiment. Recent data indicates that the Nifty 50 closed at approximately 19,500 points, representing a slight uptick of around 0.5% from the previous week. Factors contributing to this increase include strong corporate earnings reports, favorable government policies, and a resilient banking sector.

Analysts suggest that sectors such as information technology, banking, and consumer goods have played a significant role in driving the Nifty’s upward trajectory. Major companies like Reliance Industries, HDFC Bank, and Infosys have reported strong quarterly results, which has boosted investor confidence and positively influenced the index.

Factors Influencing Nifty 50 Share Price

The Nifty 50 share price is influenced by several macroeconomic factors. These include interest rates, inflation data, and foreign investment flows. Recently, the Reserve Bank of India hinted at maintaining a stable interest rate policy, which has led to increased liquidity and an influx of foreign institutional investments. This is positive news for the market as it creates further buying opportunities.

Furthermore, global factors such as U.S. Federal Reserve policies and geopolitical events have also been impacting investor sentiments. Traders closely watch these developments, as dismal international trade relations can lead to uncertainty in the stock market.

Conclusion

In summary, the Nifty 50 share price remains a crucial indicator for investors looking to gauge the Indian stock market. With its recent upward movement, it showcases a resilient economic landscape backed by robust corporate performance. However, investors should remain vigilant and consider both domestic and international factors that could affect market conditions in the coming months. As forecasts for the Nifty 50 indicate that the index could reach new heights if current trends continue, it is an exciting time for both potential and current investors in the Indian stock market.