Current Trends in NIBE Share Price: October 2023 Overview

Introduction

The share price of NIBE Industrier AB, a leading Swedish manufacturer of energy-efficient heating products, has gained significant attention in recent months. Investors and industry observers closely monitor the company’s stock to gauge its performance within the renewable energy sector, especially amid rising global demand for sustainable solutions. This article provides a comprehensive overview of the current trends in NIBE’s share price as of October 2023 and their implications for stakeholders.

Recent Performance

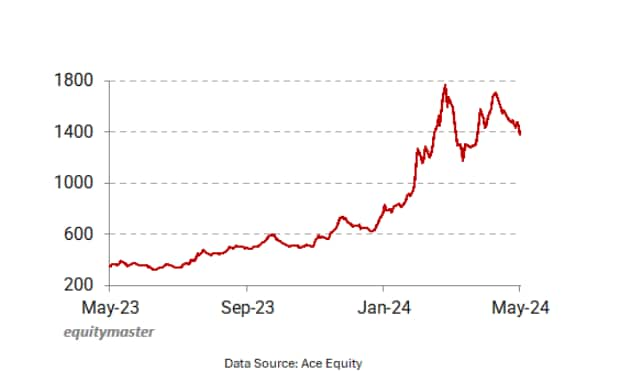

As of mid-October 2023, NIBE’s share price is recorded at approximately SEK 260, reflecting a noticeable increase of around 15% compared to last month. The company’s stock has shown resilience against market fluctuations, primarily due to its strong fundamentals and a positive outlook in the heating sector. The surge can be attributed to several key factors:

- Robust Earnings Report: NIBE recently released its Q3 earnings report, showcasing a revenue increase of 12% year-over-year, driven by higher sales in its heating technology division.

- Expansion Initiatives: The company’s commitment to expanding its manufacturing capabilities has led to strategic investments, which are anticipated to boost production capacity by 20% in the coming year.

- Growing Market Demand: With increasing awareness of climate change and sustainability, the demand for energy-efficient heating solutions is projected to rise, further benefiting NIBE.

Market Trends and Economic Indicators

The broader market trends indicate a growing investor confidence in renewable energy stocks. Factors like government subsidies for green energy technologies and rising fossil fuel prices contribute to the favorable conditions for companies like NIBE. Moreover, economic indicators reflecting a shift toward sustainable building practices signal a long-term growth avenue for NIBE’s products.

Conclusion

For investors, the current trajectory of NIBE’s share price presents a compelling opportunity, with analysts forecasting further growth as the demand for renewable energy solutions escalates. However, potential investors should remain cautious and consider market volatility and geopolitical factors that could influence performance. Overall, NIBE’s strategic positioning within the energy-efficient market underscores its significance not just for investors but also for the broader transition toward sustainable energy solutions in the years to come.