Current Trends in Nibe Share Price: Insights and Analysis

Introduction

The share price of Nibe Industrier AB, a significant player in the heating technology market, has become an important focus for investors as the demand for energy-efficient solutions grows. Nibe, known for its heat pumps and other climate control solutions, is not only crucial for the stock market but also for understanding broader trends in sustainable energy technologies. As concerns over climate change increase, companies like Nibe are at the forefront of the transition to eco-friendly heating solutions. Therefore, tracking the Nibe share price is increasingly relevant to investors interested in sustainability.

Recent Performance

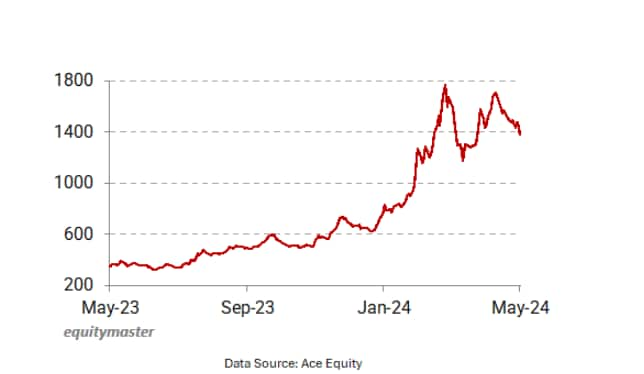

As of October 2023, Nibe’s share price has fluctuated within a tight range but showed overall positive momentum for the year. The latest reports indicate that Nibe’s stock has risen approximately 15% year-to-date, which outperforms many competitors in the heating sector. The company’s robust quarterly earnings report, which exceeded market expectations, has contributed significantly to this surge. Analysts attribute this increase to Nibe’s strategic investments in product innovation and expansion into international markets.

Key Factors Influencing Nibe Share Price

Several factors are currently influencing the Nibe share price:

- Market Trends: With the increasing focus on green technologies and government incentives for renewable energy sources, Nibe is well-positioned to benefit from rising demand.

- Corporate Performance: The latest earnings report showed a significant increase in revenues, driven by strong sales of heat pumps, particularly in Europe.

- Global Economic Conditions: Fluctuations in global markets, interest rates, and currency strength can impact Nibe’s operational costs and earnings, affecting its share price.

Future Outlook

Looking ahead, analysts predict a cautiously optimistic outlook for Nibe share price. With ongoing investments in innovation and sustainability, coupled with a favorable regulatory environment for climate-positive technologies, Nibe is expected to maintain its growth trajectory. However, potential economic downturns and raw material cost increases could present challenges. Investors are advised to watch for updates on Nibe’s strategic initiatives and economic forecasts to gauge potential impacts on share prices.

Conclusion

The Nibe share price continues to reflect the company’s strong market position and commitment to sustainable energy solutions. As the demand for energy-efficient products rises, Nibe remains a strong player in the industry. For investors, closely monitoring the stock’s performance and market trends will be crucial to make informed decisions. Whether you are a seasoned investor or new to the market, understanding the dynamics of Nibe share price can provide valuable insights into both the company and the broader trends in energy efficiency.