Current Trends in Nestle India Share Price

Importance of Nestle India Share Price

Nestle India, a subsidiary of the Swiss multinational food and beverage company Nestle S.A., is one of the leading companies in the Indian market. Tracking its share price is crucial for investors, analysts, and stakeholders as it reflects the company’s performance and market sentiment.

Recent Share Price Trends

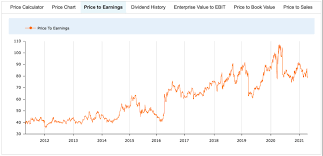

As of October 2023, Nestle India’s share price has shown notable trends influenced by various factors, including consumer demand, market competition, and economic conditions. Recently, the share price fluctuated around ₹20,000 per share, exhibiting a 5% increase over the last month, reflecting positive investor sentiment. This rise can be attributed to robust sales growth driven by diverse product offerings and a surge in demand in the packaged foods segment.

Factors Influencing Share Price

Several factors contribute to the fluctuations in the Nestle India share price. The company reported a 15% increase in net profit in its last quarterly results, driven by increased sales across its range of products, including Dairy, Baby Food, and Culinary sectors. Additionally, market analysts predict that consistent product innovations and an expansion strategy into new segments will further bolster the company’s growth.

Furthermore, Nestle India has also benefitted from rising health consciousness among consumers, leading to increased demand for its health-focused product lines. The key to maintaining a strong share price will likely hinge on how well the company adapts to changing consumer preferences and economic conditions.

Investment Outlook

Experts recommend that both current and prospective investors keep a close eye on Nestle India’s performance indicators, including its sales growth, market share, and profit margins, when considering investment decisions. While the share price has shown upward momentum, it is essential to analyze potential risks, such as supply chain disruptions and input cost inflation, which could affect profitability.

Conclusion

The share price of Nestle India serves as an important barometer for investors to assess the company’s financial health and future prospects. With a solid growth trajectory and strong brand presence, many analysts maintain a positive outlook on Nestle India’s stock. As potential investors evaluate their options, understanding the dynamics of Nestle India’s share price will be crucial in navigating the market landscape.