Current Trends in Mphasis Share Price: An Overview

Introduction

The share price of Mphasis, a leading IT services company in India, is an important indicator of its financial health and market performance. As the IT sector continues to evolve, understanding the dynamics of Mphasis’s share price is crucial for investors, analysts, and stakeholders. Given the current economic climate and the growing demand for digital services, examining the fluctuations in Mphasis’s share price can provide valuable insights into the company’s future prospects.

Current Share Price Trends

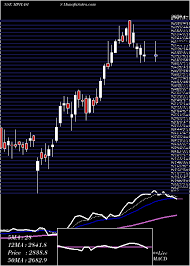

As of October 2023, Mphasis shares are trading at ₹2,350, reflecting fluctuations influenced by various factors including market sentiment, quarterly earnings, and global economic trends. In the past month, Mphasis has seen a rise of approximately 5%, buoyed by positive earnings reports and an increasing demand for tech solutions across sectors. Analysts believe that this upward trend may continue, supported by the company’s strategic investments in cloud and AI technologies, essential areas for future growth.

Factors Influencing Share Price

Quarterly Earnings Reports

The quarterly earnings reported in September 2023 showed a 10% increase in revenues year-over-year, further enhancing investor confidence. The company’s ability to secure new contracts and enhance its client base significantly influences the share price.

Market Sentiment and Investor Confidence

Market sentiment plays a critical role, especially in a sector as volatile as IT. Recent geopolitical developments and economic policies are notable influencers of investor behavior in the Indian stock market, including Mphasis shares. Positive news surrounding technological advancements and digital transformation projects adds to the optimistic outlook.

Future Outlook

Looking ahead, analysts are optimistic about Mphasis’s growth trajectory. With projections indicating continued demand for IT services, especially in automation and data analytics, Mphasis is well-positioned to capitalize on these trends. Several analysts have set a target price of ₹2,600 for Mphasis shares by the end of 2023, providing an attractive investment opportunity for those looking towards the long-term benefits of the tech sector.

Conclusion

In summary, the Mphasis share price reflects a confluence of strong earnings, positive market sentiment, and a booming demand for IT services. As the company continues to innovate and expand its service offerings, stakeholders should keep a close watch on its share price trends. With promising growth on the horizon, Mphasis remains a focal point for investors navigating the evolving landscape of the technology sector.