Current Trends in L&T Share Price

Introduction

The share price of Larsen & Toubro (L&T), a leading multinational conglomerate in India, is a key indicator of the company’s performance and the broader market sentiment. As one of the largest engineering and construction firms in the country, L&T’s share price draws significant attention from investors and analysts alike. Changes in its share price can reflect developments within the company, emerging market conditions, and the overall economic landscape of India.

Recent Performance

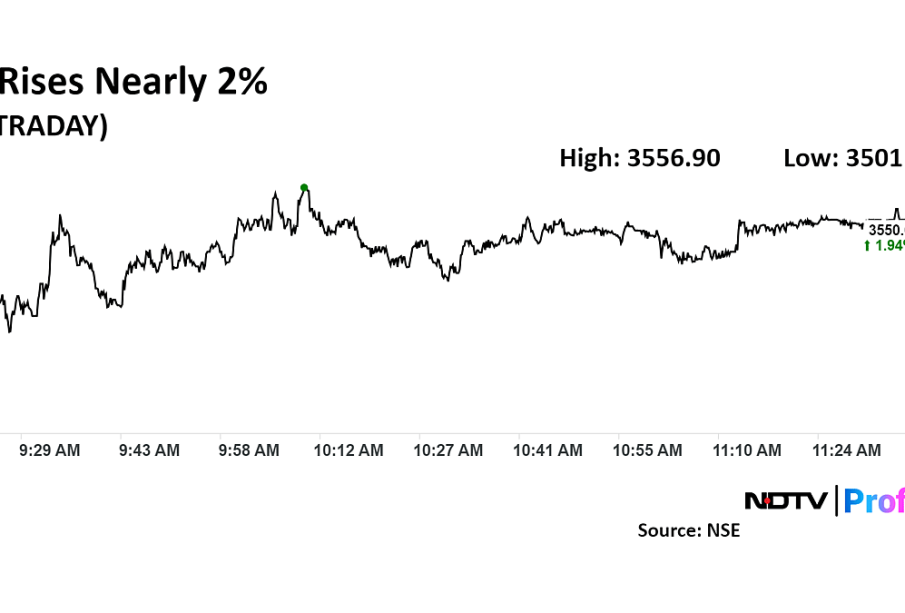

As of October 2023, L&T shares have shown resilience amidst fluctuating market conditions. Following the recent quarterly earnings report, the share price has experienced an upward trend, closing at approximately INR 2,005, a rise of about 3% compared to the previous month. The company’s steady performance in the infrastructure sector, along with robust order inflow, has contributed to positive investor sentiment.

Key Factors Affecting L&T’s Share Price

Several critical factors have been influencing L&T’s share price:

- Infrastructure Investment: The Indian government’s focus on infrastructure development and capital expenditure plans are crucial for L&T’s business. Increased public spending often leads to more projects awarded to the firm.

- Global Market Conditions: L&T also operates in international markets, and fluctuations in global commodity prices and exchange rates can impact its profitability and, consequently, its share price.

- Company Financials: Regular updates on profitability, debt levels, and overall financial health guide investor decisions. L&T recently reported a substantial increase in net profit, which boosts confidence among shareholders.

Investor Sentiment

Market analysts note that while the current economic environment presents challenges, investor sentiment regarding L&T remains optimistic. Analysts from various brokerage firms have given L&T ‘Buy’ recommendations, predicting further increases in the share price as upcoming projects and government policies are announced. However, investors are advised to be cautious as volatility in the stock market can lead to unpredictable changes.

Conclusion

Monitoring L&T’s share price is essential for investors seeking to gauge the company’s market position amid evolving economic factors. With ongoing developments in infrastructure and a positive company outlook, the share price could see further growth. For potential investors, staying updated on the company’s performance and market trends will be crucial for making informed decisions. L&T continues to play a vital role in India’s economic ambitions, and its share price serves as a barometer for the construction sector’s health.