Current Trends in KRBL Share Price

Importance of KRBL Share Price

The share price of KRBL Ltd., India’s leading rice exporter and a significant player in the FMCG sector, serves as a vital indicator of its market performance and investor confidence. As the company continues to expand its operations both domestically and internationally, fluctuations in its share price can impact investor sentiment as well as the overall market landscape.

Recent Developments

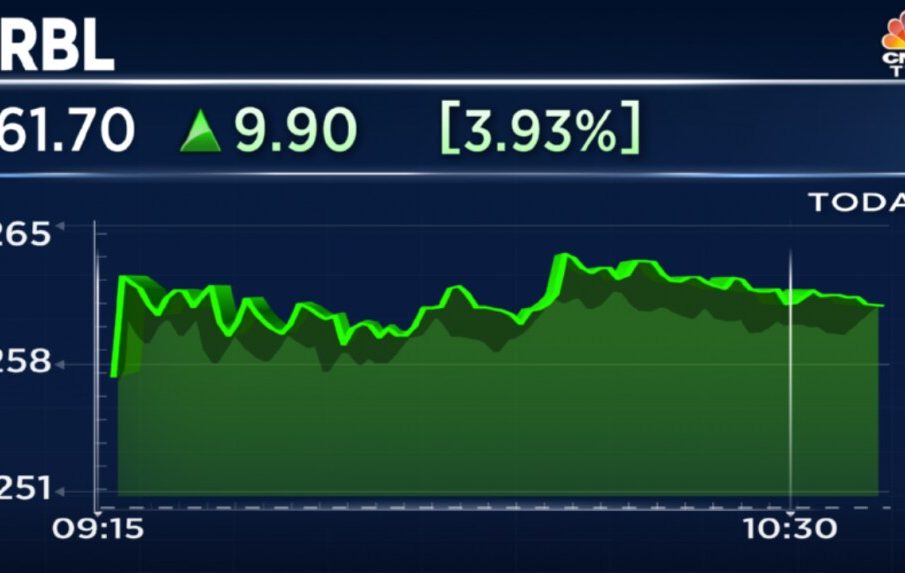

As of October 2023, KRBL share price has witnessed notable volatility, closing around ₹260 per share on the Bombay Stock Exchange (BSE). This marks a steady increase of approximately 7% over the past month, attributed to robust quarterly results and growing demand for basmati rice both in domestic and export markets.

In the recent fiscal quarter, KRBL reported a net profit of ₹80 Crore, representing a 15% increase year-on-year. Analysts attribute this growth to the company’s efficient supply chain, increased production capacity, and higher market share in the basmati segment. Additionally, strategic marketing initiatives have significantly enhanced brand visibility, further boosting sales.

Factors Influencing Share Price

Several factors are currently influencing the KRBL share price. Firstly, global demand for basmati rice has surged due to its heightened popularity in various international markets, particularly in the Middle East and Europe. Furthermore, favorable weather conditions leading to improved agricultural outputs have positively impacted production efficiency.

Additionally, the overall stock market trends and government policies toward agricultural exports significantly influence KRBL’s share price. The recent budget announcements advocating subsidies for rice exporters have further fueled positive investor sentiment.

Looking Ahead

Experts forecast a bullish outlook for KRBL Ltd in the upcoming quarters. Given the projected growth in demand and the company’s initiatives to enhance its production capabilities, analysts predict that KRBL share price could range between ₹280 to ₹300 by the end of the financial year. However, potential investors are advised to conduct thorough market research and consider external economic factors before making any investment decisions.

Conclusion

In summary, KRBL’s share price remains a critical metric for investors navigating the dynamics of the FMCG and agribusiness sectors. With an optimistic growth trajectory fueled by international demand and operational efficiency, stakeholders should keep a close watch for future developments that could impact share valuations.