Current Trends in JSW Steel Share Price

Introduction

The share price of JSW Steel, one of India’s leading steel manufacturers, is a critical indicator in the stock market, reflecting the company’s health and broader economic trends. As steel is a fundamental component in various industries, fluctuations in its share price can have significant implications for investors and the economy as a whole. Understanding these dynamics is vital for stakeholders looking to make informed decisions.

Current Share Price Overview

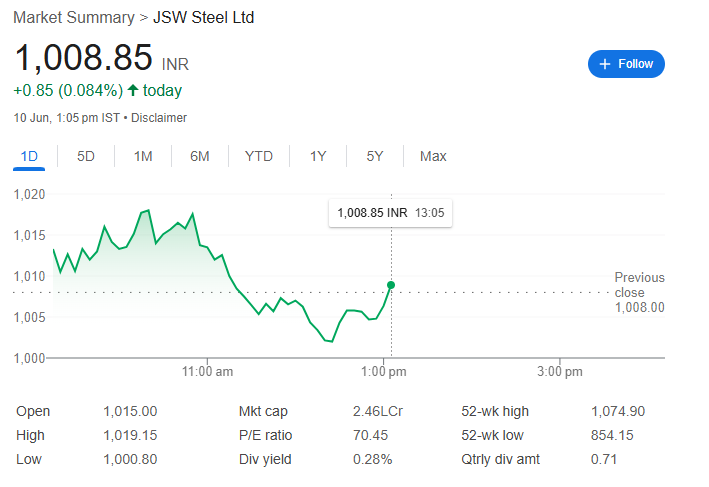

As of October 2023, JSW Steel’s share price has shown a considerable fluctuation due to various market factors. The stock opened at approximately INR 710 and has experienced peaks and troughs influenced by global steel demand, domestic production rates, and changes in policy regulations. Recently, reports indicate that the share price reached an all-time high of INR 750, driven by positive quarterly earnings that exceeded market expectations.

Factors Influencing Share Price

Several factors are currently impacting the fluctuations in JSW Steel’s share price:

- Global Steel Demand: As economies worldwide emerge from the pandemic, the demand for steel has seen a resurgence. The revival of the construction and automotive sectors is further bolstering this demand.

- Raw Material Costs: The costs of iron ore and coal, essential raw materials for steel production, have been volatile. Increases in these costs can affect profitability, thereby influencing investor sentiment.

- Government Policies: The Indian government’s initiatives towards infrastructure development, such as the National Infrastructure Pipeline (NIP), have created a favorable environment for steel demand, subsequently impacting share prices positively.

- Competitive Landscape: The competition within the steel sector plays a pivotal role, with players like Tata Steel also vying for market share, affecting JSW Steel’s strategies and pricing.

Conclusion

In conclusion, the share price of JSW Steel continues to be subjected to various external and internal factors that create a dynamic investment landscape. Analysts project that with continued demand for steel in infrastructure and manufacturing, alongside effective operational strategies, JSW Steel’s share price could maintain an upward trajectory, making it an intriguing option for investors. However, potential investors should remain vigilant regarding raw material price changes and global economic conditions, which could affect the stock’s future performance.