Current Trends in JSW Infra Share Price

Introduction

JSW Infrastructure is a significant player in India’s infrastructure sector, focusing on ports and logistics. Its share price is crucial for investors and analysts as it reflects its market performance and potential future growth. Understanding the fluctuations in JSW Infra’s share price can help investors make informed decisions in a competitive environment.

Recent Developments

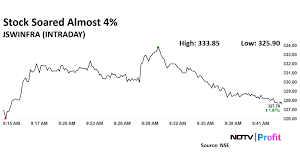

As of mid-October 2023, JSW Infra’s share price has shown considerable activity, experiencing fluctuations that reflect broader market trends. Recently, the stock opened at ₹300.00 per share, showcasing a steady incline over the last month. Analysts attribute this rise to strategic expansions and announcements regarding new projects in the port sector, vital for enhancing trade efficiency in India.

Company Performance

In the latest quarterly report, JSW Infrastructure reported a 15% year-on-year increase in revenue, primarily driven by higher cargo handling volumes at its ports. This robust financial performance has contributed to positive sentiment among investors, further bolstering the company’s market capitalization and stock price. Moreover, institutional investments have increased, indicating growing confidence in the company’s long-term vision.

Market Analysis

Market analysts speculate that JSW Infra’s share price could continue to rise in the coming months, driven by the government’s push for infrastructure development, especially through initiatives aimed at boosting the logistics sector. Analysts have set a target price range of between ₹320 to ₹350 based on current market conditions and projected earnings growth. However, potential risks include fluctuations in commodity prices and economic slowdowns, which could impact overall performance.

Conclusion

In conclusion, investors should closely monitor the movements of JSW Infra’s share price, given its strategic importance in the infrastructure sector. With strong financials and favorable market conditions, many believe it holds significant potential for growth. However, being aware of market fluctuations and external economic factors will be key to making informed investment decisions. Investors are encouraged to conduct thorough research and possibly consult financial advisors before making any significant investment.