Current Trends in ITC Hotels Share Price

Introduction

As one of the leading hospitality brands in India, ITC Hotels has been a significant player in the hotel industry. The share price of ITC Hotels is not only vital for investors but also reflects the overall performance of the hospitality sector in the country. In recent times, understanding the dynamics of the share price has become even more critical, particularly in light of the economic fluctuations and changes in tourist behavior post-pandemic.

Recent Performance

As of October 2023, ITC Hotels has witnessed substantial growth in its share price, rallying over 10% in the past month alone. This rise can be attributed to several factors, including increased domestic travel, a resurgence of corporate travel, and effective management strategies executed by the company. According to stock market analysts, the current share price is influenced by strong quarterly earnings reports that indicate recovery in the hospitality sector. In the last quarter, ITC Hotels reported a significant increase in revenue, marking a 25% growth year-on-year, which has bolstered investor confidence.

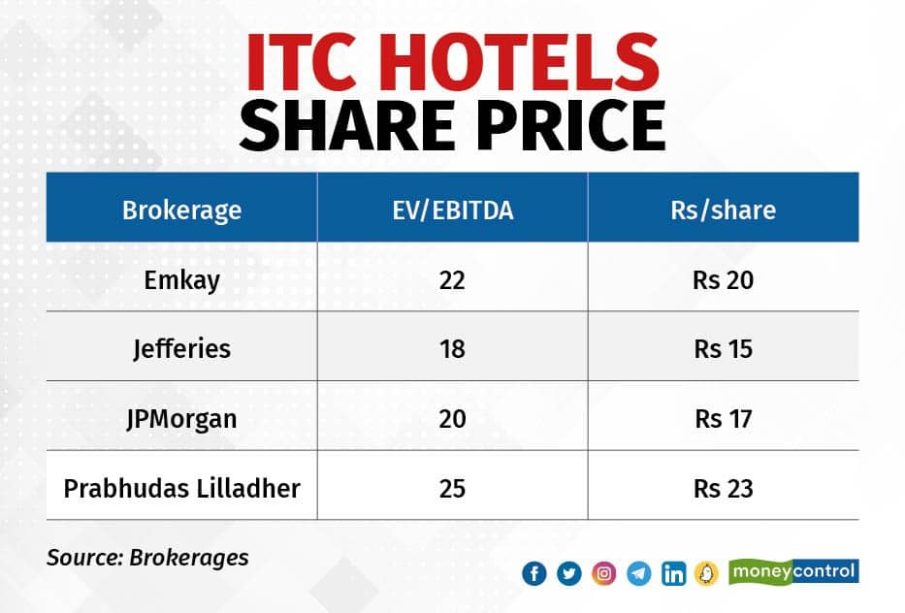

Market Response and Analyst Forecasts

The bullish trend surrounding ITC Hotels has prompted market experts to issue favorable forecasts for its share price. Analysts predict that with the upcoming festive seasons and an anticipated rise in occupancy rates, the stock could continue its upward trajectory. Many are optimistic that the company’s practices in sustainability and premium service will attract a larger clientele, thereby further enhancing profitability.

However, while the outlook remains bright, investors are advised to consider potential risks, such as changing travel regulations and economic downturns that could impact travel habits. A diversification strategy might be prudent for those heavily invested in hospitality stocks.

Conclusion

In conclusion, the share price of ITC Hotels serves as an important indicator of not just its operational success but also the broader trends within the Indian hospitality market. For investors, keeping a close eye on economic indicators and company performance is essential. As the market evolves, ITC Hotels is positioned to take advantage of growth opportunities, making its share price a subject of interest for both current and prospective investors.