Current Trends in IRCTC Share Price

Introduction

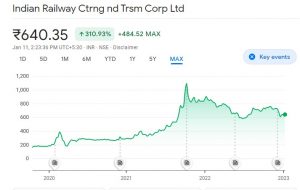

The IRCTC (Indian Railway Catering and Tourism Corporation) share price holds significant importance for investors and stakeholders in the Indian stock market. As a key player in the railway catering and tourism sector, fluctuations in its share price can affect not only individual investments but also broader market trends. Recently, IRCTC has shown a dynamic response to market demands, making it a focal point for investors.

Current Market Performance

As of late October 2023, the IRCTC share price is trading at approximately ₹650, showing a year-to-date change of around 15%. The company’s shares have recently witnessed a bullish trend following reports of increased ticket bookings and a revival in domestic tourism. Positive market sentiments have been further bolstered by announcements of strategic partnerships aimed at enhancing their digital services, which are expected to drive revenue growth.

Factors Influencing the Share Price

1. Passenger Growth: With Indian Railways recording a surge in passenger numbers post-COVID recovery, the increase in ticket sales directly impacts IRCTC’s earnings.

2. Digital Expansion: The company’s efforts to enhance online booking systems, it has reported an increase in transactions through its mobile application, which contributes to a higher market valuation.

3. Government Policies: Initiatives by the government to boost tourism and infrastructure can play a significant role in shaping IRCTC’s performance, making it essential to monitor policy changes closely.

Investment Outlook

According to analysts, the IRCTC share price is expected to remain volatile in the short term due to external factors such as global market trends and economic conditions. However, the long-term outlook appears positive, with predictions suggesting that the share might reach levels up to ₹750 within the next six months, assuming continued recovery in the tourism sector and effective execution of their strategic plans.

Conclusion

The IRCTC share price remains a crucial metric for both investors and the broader market. With ongoing improvements in the travel industry and strategic initiatives by the company, IRCTC is poised for possible gains in the foreseeable future. Investors should keep an eye on market trends and operational updates from the company to make informed decisions.