Current Trends in IRCTC Share Price

Introduction

IRCTC (Indian Railway Catering and Tourism Corporation) is a significant player in India’s railway sector, especially after its IPO in 2019. The performance of IRCTC’s share price is crucial not only for investors but also for the economy, as it reflects the growth of India’s travel and tourism industry. As of October 2023, the IRCTC share price has attracted considerable attention due to various factors affecting its market performance.

Current Performance and Factors Influencing Price

As of mid-October 2023, the IRCTC share price has seen a fluctuation in recent months, currently trading around ₹650, slightly up from earlier lows. Several factors are influencing this price movement:

- Increased Revenue: The company’s revenue has surged as domestic travel picks up post-pandemic. Recent quarterly reports indicate a significant increase in passenger bookings and catering services.

- Government Initiatives: With the government’s push towards digitization and modernization of railways, the effective implementation of various initiatives is expected to further boost IRCTC’s market position.

- Market Sentiment: Global economic conditions, inflation rates, and investor sentiment significantly impact the share price. Recent economic reports indicate cautious optimism, which has contributed positively to IRCTC’s stock performance.

Analyst Opinions and Future Forecasts

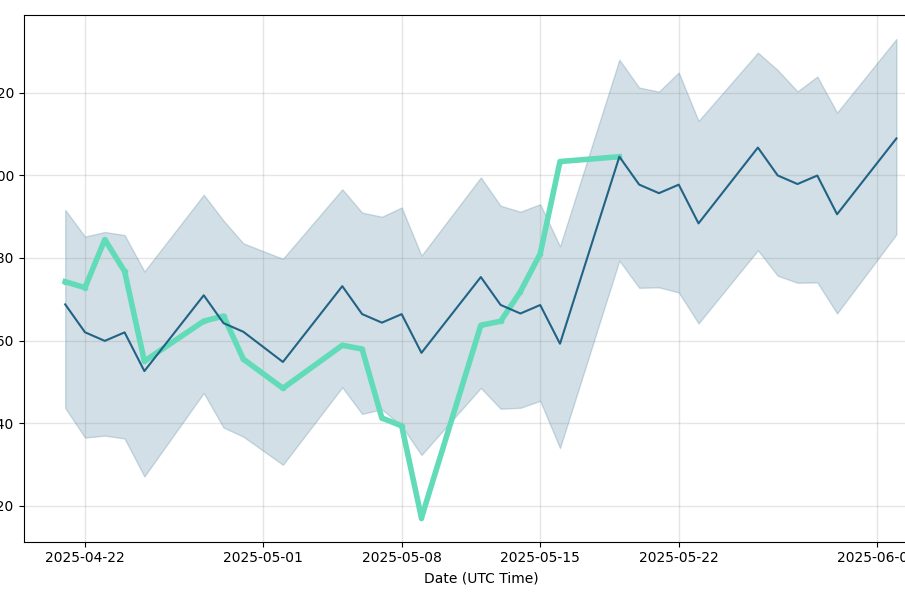

Market analysts remain divided in their opinions about the future of IRCTC’s share price. Some predict that the stock may see bullish trends as essential economic indicators remain favorable. Renowned brokerage firms suggest a target price of ₹750 within the next 12 months, driven by expected growth in online ticketing and catering services.

Conversely, some analysts warn of potential volatility due to competitive pressures and fluctuating operational costs. They emphasize the importance of monitoring quarterly earnings reports and overall macroeconomic conditions as indicators of future performance.

Conclusion

The IRCTC share price remains a closely watched metric in the stock market driven by factors such as recovery post-COVID, government strategies, and market sentiment. For investors, staying updated on these metrics will be crucial for making informed decisions. As travel demand continues to recover and the company expands its services, the potential for growth remains significant, prompting renewed interest from both retail and institutional investors. The future may hold promising prospects for IRCTC, but careful analysis and a watchful eye on market developments will be vital for navigating the complexities of investment in this sector.