Current Trends in Infosys Infy Share Price

Introduction

Infosys, one of India’s leading IT services companies, has seen notable fluctuations in its share price recently. Understanding these movements is vital for investors and market analysts who are tracking the trends of technology stocks in India. The performance of Infosys is crucial not just for its stakeholders, but also for the overall index performance of major stock exchanges in the country.

Current Market Performance

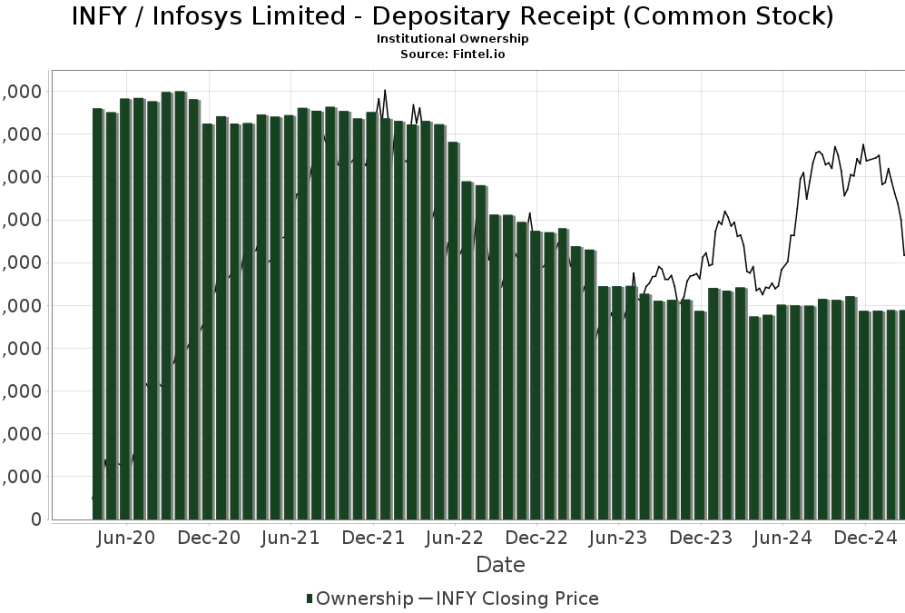

As of October 2023, the price of Infosys shares has shown considerable volatility, reflecting broader trends in the technology sector. After a consolidation phase earlier in the year, the stock price climbed sharply following the announcement of strong quarterly results in September, where the company reported a 15% year-on-year revenue growth. Following these results, the Infy share price reached an all-time high of ₹1,800 per share.

Industry analysts attribute this rise to the company’s strategic investments in digital services, which have garnered better margins. Furthermore, the ongoing demand for IT solutions in various sectors, including finance and healthcare, continues to bolster investor confidence. However, external factors such as geopolitical tensions and fluctuations in currency rates continue to pose challenges.

Expert Opinions and Future Forecasts

Market experts maintain a positive outlook on the long-term prospects of Infosys. Many predict that, as companies globally accelerate their digital transformation initiatives, the demand for IT services will surge. Brokerage firms have adjusted their target prices for Infosys shares, with many suggesting it could reach between ₹1,900 to ₹2,000 in the next 12 months.

Nonetheless, it is essential for investors to keep a close watch on macroeconomic indicators that could disrupt this positive trajectory, such as changes in US monetary policy or inflation rates in the Indian economy. These factors could influence not just the share price of Infosys, but the entire tech sector.

Conclusion

In conclusion, the current trends in the Infy share price reflect both the company’s robust performance and the broader economic landscape. With strong fundamentals and demand for IT solutions, there remains potential for growth in the coming months. However, investors should remain cautious of external economic factors and market sentiment fluctuations, which could impact share prices significantly. Being well-informed will be key for stakeholders as they navigate the fluctuating landscape of equity investment.