Current Trends in IndusInd Bank Share Price

Introduction

The share price of IndusInd Bank, one of India’s leading private sector banks, has become a point of interest among investors and analysts alike. Recent fluctuations in its market value are indicative of broader trends in the banking sector and the Indian economy. Understanding these trends is crucial for investors looking to make informed decisions.

Current Market Situation

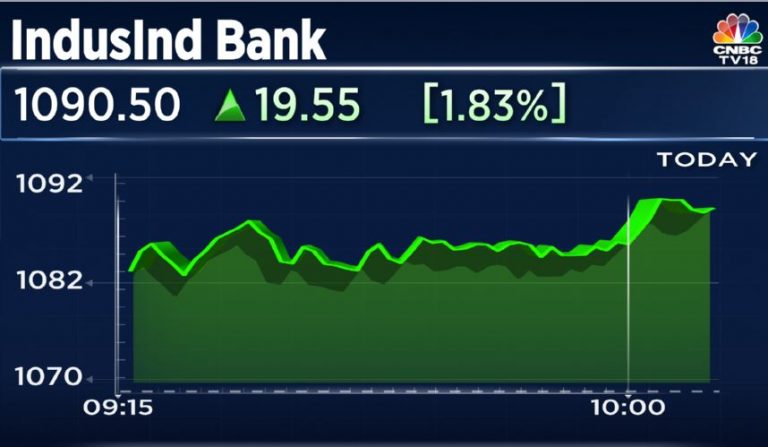

As of October 2023, the share price of IndusInd Bank was trading at approximately ₹1,100, having shown a moderate increase of 5% over the past month. This rise comes on the back of positive quarterly results released in September, where the bank reported a net profit of ₹1,200 crores, reflecting a 20% year-on-year growth. The bank’s performance has been bolstered by an increase in net interest income and a reduction in bad loans, contributing to favorable investor sentiment.

Factors Influencing Share Price

Several key factors have influenced the fluctuations in IndusInd Bank’s share price over the past few months:

- Economic Recovery: As India’s economy continues to recover post-pandemic, consumer spending and loan demand have surged, benefiting banks like IndusInd.

- Government Initiatives: Recent government initiatives aimed at boosting credit growth have positively impacted the banking sector.

- Market Sentiment: Investor confidence has been bolstered by reports of a stable interest rate environment maintained by the Reserve Bank of India.

- Global Trends: Global economic conditions, including inflation rates and supply chain issues, continue to create volatility in financial markets, impacting share prices.

Future Outlook

Looking ahead, analysts are cautiously optimistic about the future of IndusInd Bank’s share price. Based on current trends, they project a potential growth to ₹1,200 within the next six months, contingent on the bank maintaining its profit margins and managing asset quality effectively. However, risks remain, including possible regulatory changes and economic disruptions that could affect financial performance.

Conclusion

In summary, the IndusInd Bank share price reflects both the health of the banking sector and the broader Indian economy. For investors, keeping an eye on the upcoming market trends and the bank’s quarterly performance will be essential for making informed investment choices. With a potentially bullish outlook, informed investors can capitalize on opportunities while remaining aware of the associated risks.