Current Trends in IDBI Bank Share Price

Importance of Monitoring IDBI Bank Share Price

The performance of IDBI Bank share price is crucial for investors and stakeholders as it reflects the bank’s financial health and market position. Analyzing the share price trend can help investors make informed decisions, be it for long-term investment or trading.

Recent Performance

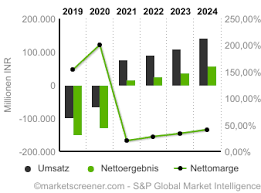

As of October 2023, IDBI Bank has shown significant variations in its share price due to several influencing factors. The current share price stands at ₹60 per share, which marks an increase of approximately 8.5% over the past month. This surge can be attributed to improved quarterly financial results, which indicated an increase in net profit by 45% year-on-year, reaching ₹1,250 crore in the second quarter of FY2023-24.

Market Influences

The rise in IDBI Bank’s share price has been driven by various factors, including an upward trend in credit growth, a reduction in non-performing assets (NPAs), and overall positive sentiment in Indian banking due to favorable government policies. Additionally, analysts point out that global factors, such as foreign investment and the stability of the Indian economy, have also played a role.

Technical Analysis

Technical analysis indicates that the share price has recently crossed above its 50-day moving average, signaling a potential bullish trend. However, analysts recommend caution, urging investors to keep an eye on key support levels around ₹55 and resistance levels at ₹65, as fluctuations are possible.

Future Outlook

Experts predict that IDBI Bank share price may continue on an upward trajectory in the near future, contingent on sustained economic growth and further improvements in the bank’s financial metrics. However, potential investors should remain vigilant about market volatility and global economic factors that could impact share performance. Overall, IDBI Bank remains an appealing option for investors looking to explore opportunities in the banking sector.

Conclusion

Keeping track of IDBI Bank share price is vital for making informed investment choices. As the bank continues to show promising financial results and maintains a positive growth outlook, it could be a strong candidate for investment in the financial sector. Investors are encouraged to stay updated with ongoing market developments to maximize their investment strategy.