Current Trends in Hyundai India Share Price

Introduction

Hyundai Motor Company is a significant player in the Indian automotive sector, and its share price is a critical indicator of its market performance and investor sentiment. Tracking the share price of Hyundai India helps investors and analysts understand the company’s growth potential, the impact of market conditions, and the overall health of the automotive industry in India.

Current Share Price Trends

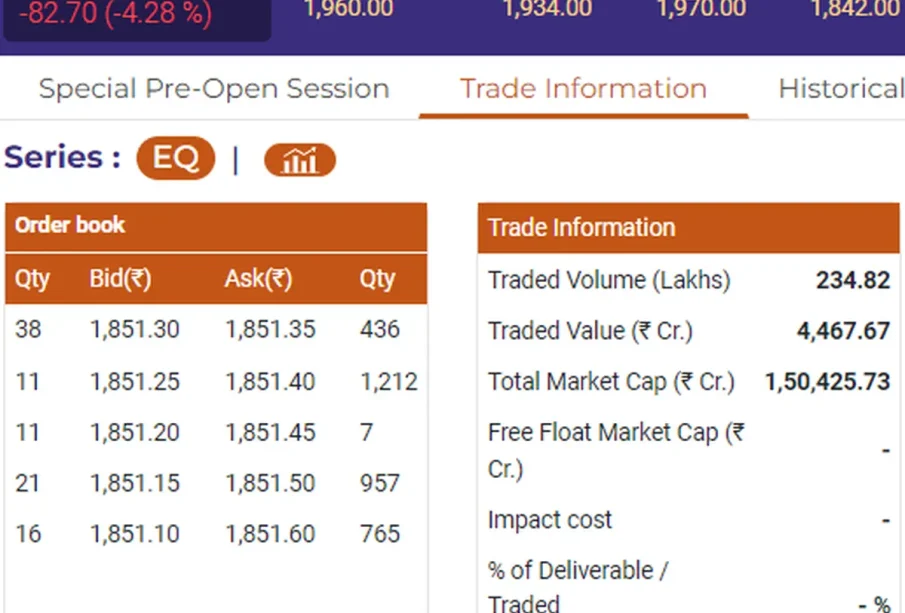

As of the latest trading session, Hyundai India’s share price has shown a volatility pattern in sync with the broader market trends. At the end of October 2023, Hyundai’s shares were trading at approximately INR 1,300, reflecting a modest rise of 2% compared to the previous month. Several factors are contributing to this price movement, including the launch of new vehicle models, fluctuations in the global supply chain, and the company’s strong sales reports for the last quarter.

Hyundai’s commitment to electric vehicles (EVs) is also influencing share price trends, with recent announcements of investments in green technology and plans to introduce eco-friendly models in India boosting investor confidence.

Market Influencers

The Indian automotive market is currently experiencing a transformative phase, influenced by a shift towards electric mobility and sustainability. Hyundai’s strategic initiatives to expand its EV lineup and improve manufacturing capabilities align with government policies promoting green technology. As such, investor interest remains high, further aiding in the stabilization of share prices amidst market volatility.

Moreover, competition from domestic and international players, changes in consumer preferences, and regulatory aspects related to emissions and safety standards are essential components to consider when analyzing Hyundai’s share price.

Conclusion

The share price of Hyundai India is closely tied to overall market trends and the automotive sector’s evolution towards innovation and sustainability. Analysts suggest that if Hyundai continues on its current trajectory of innovation, particularly in EVs, the share price is likely to see upward momentum in the foreseeable future. For investors, Hyundai presents a significant opportunity, but it is essential to stay informed about market changes and consumer trends that could affect share value. Keeping an eye on developments in government regulation and economic conditions will also be critical for forecasting Hyundai’s market performance in India.