Current Trends in HUL Share Price

Introduction

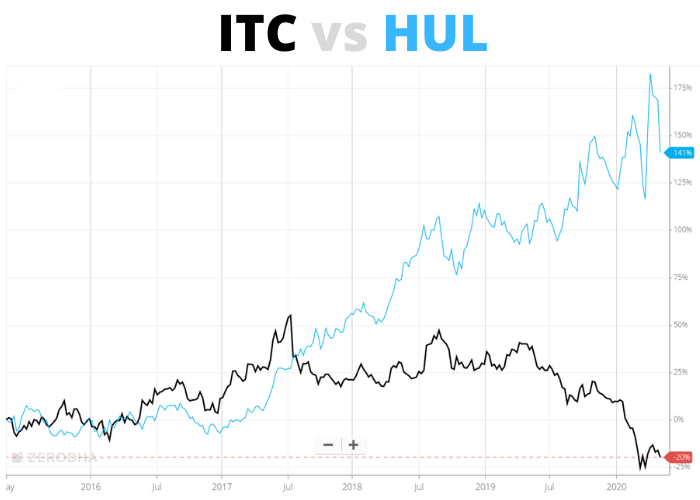

The Hindustan Unilever Limited (HUL) share price is a key indicator of the performance of one of the largest consumer goods companies in India. As a leading player in sectors such as personal care, food, and home care, HUL’s market performance is closely watched by investors and analysts alike. In a dynamic economy, fluctuations in HUL’s share price can significantly signal trends within the broader market and consumer sentiment.

Latest Performance and Factors Influencing HUL Share Price

As of October 2023, HUL’s share price is experiencing notable volatility, influenced by various factors such as quarterly earnings reports, consumer demand trends, and macroeconomic conditions. Recent reports indicate that HUL has shown robust growth, with a 15% increase in revenue year-over-year, attributed largely to rising consumer demand and strategic product launches.

In the last quarter, HUL reported an earnings per share (EPS) that surpassed analysts’ expectations, primarily driven by its strong performance in the personal care segment, especially in skincare and hygiene products. The company’s ability to adapt to changing consumer preferences, particularly post-pandemic, has also contributed positively to investor sentiment.

Market Reactions and Analyst Predictions

The market has reacted positively to these developments, with many analysts rating HUL’s stock as a ‘buy’. According to leading financial institutions, the HUL share price is expected to stabilize and possibly rise further, bolstered by consistent demand for essential products and effective supply chain management. Other factors such as inflation, raw material costs, and governmental policies on FMCG sectors are also considered vital, as they can influence operational costs and profit margins.

Conclusion

The HUL share price remains a vital area of focus for investors looking to gauge market health and consumer trends in India. As the company continues to innovate and respond to market demands, its stock performance is likely to reflect broader economic conditions. Investors should keep an eye on upcoming earnings reports and market trends to make informed decisions regarding HUL shares.