Current Trends in HPCL Share Price: An Overview

Introduction

HPCL, or Hindustan Petroleum Corporation Limited, is one of India’s leading oil refining and marketing companies. As a government-owned corporation, it holds a significant position in the energy sector and plays a vital role in fueling the nation’s growth. Tracking its share price is crucial for investors, market analysts, and stakeholders interested in understanding the health of the energy market.

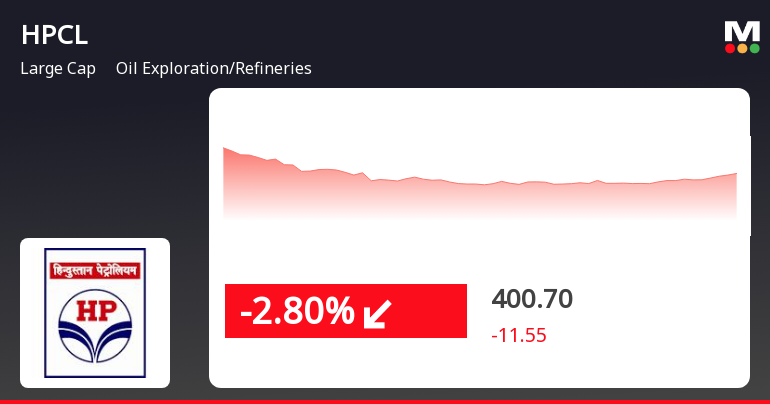

Recent Share Price Movements

As of just last week, HPCL’s share price has witnessed notable fluctuations, hitting a high of ₹330 and dipping to around ₹300. According to market analysts, this variability can be attributed to a mix of global crude oil price changes, domestic demand fluctuations, and government policy adjustments. Over the past month, HPCL’s shares have shown an upward trend, reflecting the overall recovery in the energy sector post-pandemic.

Factors Influencing HPCL Share Price

- Global Crude Prices: The price of crude oil has a direct impact on HPCL’s profitability and share price. Recent geopolitical tensions and OPEC decisions have substantially affected crude prices that, in turn, impact HPCL’s margins.

- Domestic Fuel Demand: India’s energy consumption is on the rise as economic activities resume post-COVID. The demand for petroleum products is crucial for HPCL’s performance, making it imperative for investors to monitor domestic consumption trends.

- Government Policies: Policies related to fuel pricing, subsidies, and renewable energy initiatives significantly impact HPCL. Investors are keen to analyze changes in government regulations and their potential implications on the company.

Market Outlook

Analysts predict a cautious yet optimistic outlook for HPCL shares in the near term. With the government pushing for greater energy independence and investments in renewable sources, HPCL may diversify its portfolio, which could positively influence its market position. It is expected that share price will closely correlate with oil prices and demand trends as the global economy continues to bounce back.

Conclusion

HPCL’s share price is a critical indicator of the company’s performance and a reflection of the broader energy market in India. For investors, keeping an eye on both local and global factors that affect crude oil prices, and subsequent demand for petroleum products is essential. As HPCL navigates these market challenges, its ability to adapt and innovate will be key in determining its future share price trajectory.