Current Trends in HFCL Share Price

Introduction

HFCL Limited, a prominent player in the telecom and network solutions sector, has been a focal point for investors looking to capitalize on the growing digital infrastructure demand in India. The company specializes in manufacturing high-quality telecom equipment, including fiber optic cables, and is actively involved in projects related to 5G network rollout. Consequently, understanding the dynamics of HFCL’s share price is crucial for investors navigating the stock market.

Current Share Price Trends

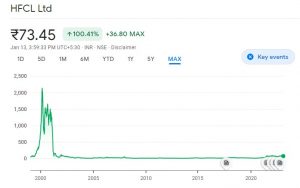

As of mid-October 2023, HFCL’s share price has shown significant fluctuations, with recent trading sessions reflecting high volatility. The stock price was reported at ₹82.50, marking a rise of approximately 2.5% from the previous week. Analysts attribute this uptick to various factors, including positive quarterly earnings, an increase in demand for telecom products, and strategic partnerships that promise future growth.

Market Analysis

Market analysts suggest that the recent trend in HFCL share prices might be influenced by the overall economic environment and government initiatives aimed at boosting digital infrastructure. The Union Budget has laid out substantial allocations for telecommunications, indicating that companies like HFCL are well-positioned to capitalize on these developments. Furthermore, investor sentiment is optimistic due to HFCL’s robust order book, which is bolstered by ongoing projects in 5G and broadband expansion.

Future Outlook

Looking ahead, many experts predict a bullish trend for HFCL shares if the company continues to secure government contracts and maintain its trajectory of innovation. The anticipated rollout of 5G networks across India is expected to serve as a significant growth catalyst. If HFCL can expand its market share and enhance operational efficiencies, analysts believe the share price could see considerable appreciation in the coming quarters.

Conclusion

In conclusion, HFCL’s share price serves as a barometer for the company’s performance in a rapidly evolving telecom landscape. Investors are encouraged to monitor HFCL’s activity closely, as strategic decisions and market conditions will play a critical role in determining future share price movements. As digital infrastructure becomes ever more vital, HFCL stands at the forefront, poised for potential growth that could enhance shareholder value.