Current Trends in Glottis Share Price

Importance of Tracking Glottis Share Price

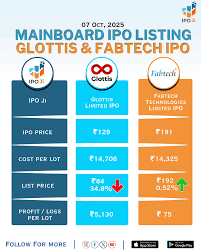

In the rapidly changing environment of stock markets, understanding the share prices of key companies is vital for investors. Glottis, a prominent player in the tech industry, has recently been under scrutiny due to fluctuating share prices influenced by global economic conditions.

Recent Developments Affecting Glottis Shares

As of October 2023, Glottis’s share price has exhibited significant volatility. Starting the month at INR 850, it saw a peak of INR 915 before retracting to around INR 870 in the latest trading sessions. This fluctuation can be attributed to a combination of factors, including weaker-than-expected quarterly earnings and geopolitical tensions that impact tech supply chains.

Moreover, the recent announcement of a strategic partnership with a major software company aimed at enhancing cloud capabilities has generated positive sentiments among investors. However, analysts have advised caution, urging investors to consider the potential risks associated with changing market dynamics.

Market Predictions and Investor Sentiments

Analysts project that the Glottis share price will likely stabilize over the next quarter, possibly reaching the INR 900 mark again if the strategic partnership yields positive outcomes. Investor sentiments remain mixed, with some predicting a bullish turn as the company adapts to market demands, while others express concerns about overall market performance.

Conclusion

Understanding the fluctuations in Glottis share price is crucial for current and potential investors. As the company navigates through its strategic initiatives and external pressures, staying informed about market trends and forecasts will be key. The upcoming financial reports and market analyses will play a significant role in shaping the future of Glottis shares. Investors should regularly review their holdings and strategies to effectively respond to these changes.