Current Trends in Gensol Engineering Share Price

Introduction

The share price of Gensol Engineering has become a critical topic for investors, analysts, and market enthusiasts as it reflects the company’s performance and growth potential. Gensol Engineering, a prominent player in the renewable energy sector, specializes in engineering solutions for various industries, making it a significant stock in the Indian market. Understanding its share price movements is essential for both current investors and potential stakeholders.

Recent Share Price Performance

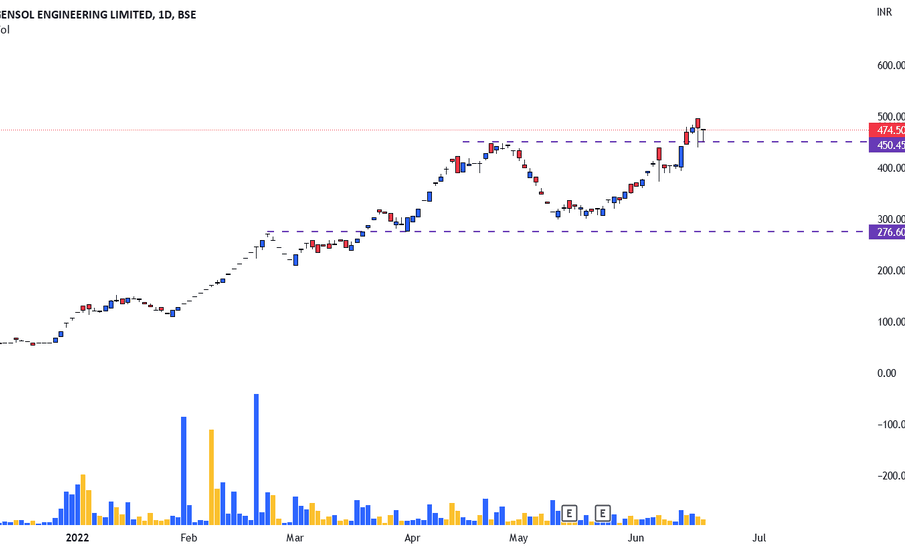

As of the latest trading session, Gensol Engineering (NSE: GENSOL) recorded a share price of ₹1,025, reflecting a minor increase of 1.5% in the past week. Over the past month, the stock has shown volatility but an overall upward trend, rising approximately 10% from ₹930 to the current level. Analysts attribute this increase to the growing focus on clean energy investments, as well as Gensol’s recent contracts acquired in solar and wind energy projects, bolstering investor confidence.

Factors Influencing Share Price

A few key factors have been influencing Gensol Engineering’s share price recently:

- Market Demand for Renewable Energy: As the world shifts towards sustainable energy, companies like Gensol are poised to benefit, leading to increased investor interest.

- Government Initiatives: The Indian government’s push for renewable energy sources has created a conducive environment for companies in this sector, thereby positively impacting share prices.

- Financial Performance: Gensol Engineering reported robust quarterly results, with a significant increase in revenue due to new contracts, boosting investor sentiments.

Conclusion

In conclusion, Gensol Engineering’s share price is reflective of its strong market position and the burgeoning demand for renewable energy solutions. As the company continues to expand its services and capture new projects, its share price is likely to experience further growth. Investors should monitor market trends, government policies, and the company’s financial health to make informed decisions. The overall outlook for Gensol Engineering remains positive, with many analysts predicting a stable increase in share value over the coming months.