Current Trends in Enviro Infra Share Price

Introduction to Enviro Infra

Enviro Infra, a prominent player in the renewable energy and environmental infrastructure sector, is gaining attention due to its innovative solutions aimed at addressing climate change and promoting sustainable practices. The share price of Enviro Infra is not only a reflection of the company’s financial health but also an indicator of investor confidence in the growing green energy market. As more attention turns toward sustainability, understanding the fluctuations in its share price becomes crucial for investors.

Recent Performance of Enviro Infra Shares

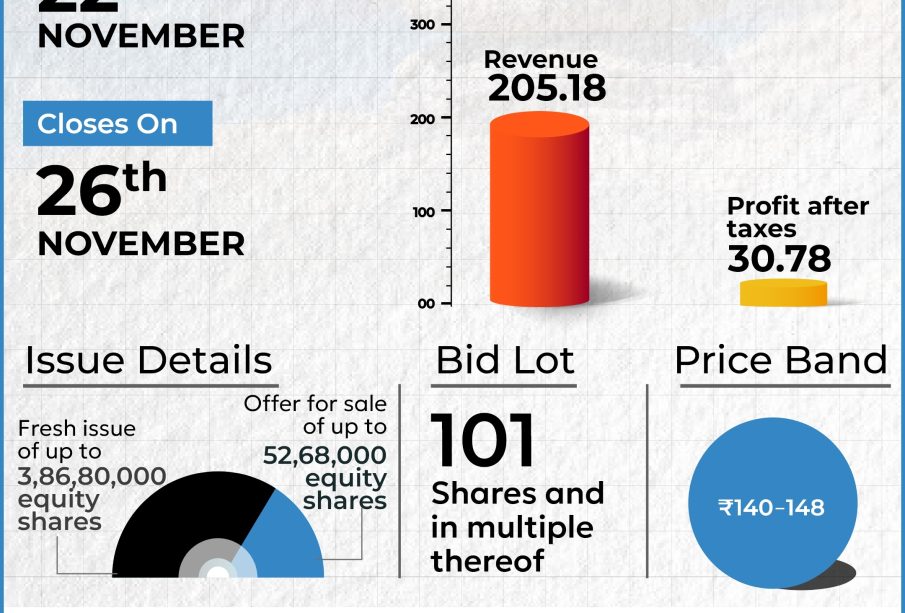

As of October 2023, Enviro Infra’s share price has shown significant volatility. Over the past month, the stock has experienced an upward trend, reaching a peak of ₹150 before stabilizing around ₹145 per share. Analysts attribute this rise to the company’s recent contracts secured for solar and wind energy projects, alongside government initiatives that prioritize renewable energy investments.

In the last quarterly report, Enviro Infra announced a revenue growth of 25% compared to the previous year, which further boosted investor sentiments. However, some analysts caution that the share price could be susceptible to market corrections given the overall fluctuations in the renewable energy sector.

Factors Influencing the Share Price

Several key factors play a role in the movement of Enviro Infra’s share price:

- Market Demand: Increasing global emphasis on renewable energy solutions has heightened demand for companies like Enviro Infra.

- Government Policies: Favorable regulations and incentives provided by the Indian government to support clean energy initiatives positively impact the stock.

- Investor Sentiment: Changes in investor sentiment towards climate action and sustainable practices drive pricing dynamics.

Conclusion and Future Outlook

The Enviro Infra share price represents more than just a figure on a stock market ticker; it embodies the potential for growth in the green energy sector and the increasing shift towards sustainable infrastructure. Given the current trend and market forecasts, analysts suggest that the stock may continue to rise as the company expands its operational capabilities.

For current investors, watching for immediate market reactions to news related to legislation regarding clean energy and new project announcements will be vital. Investors considering entering the market should remain attentive to these factors and potential market corrections, ensuring informed investment decisions in this progressive sector.