Current Trends in DMart Share Price: A Comprehensive Analysis

Introduction

DMart, a leading Indian retail chain, has captured significant attention among investors due to its consistent growth and profitability. The share price of DMart is a crucial indicator for many in the stock market, especially given the recent fluctuations in the Indian retail sector. Understanding the current trends in DMart’s share price is vital for both seasoned investors and those looking to enter the market.

Current Share Price Trend

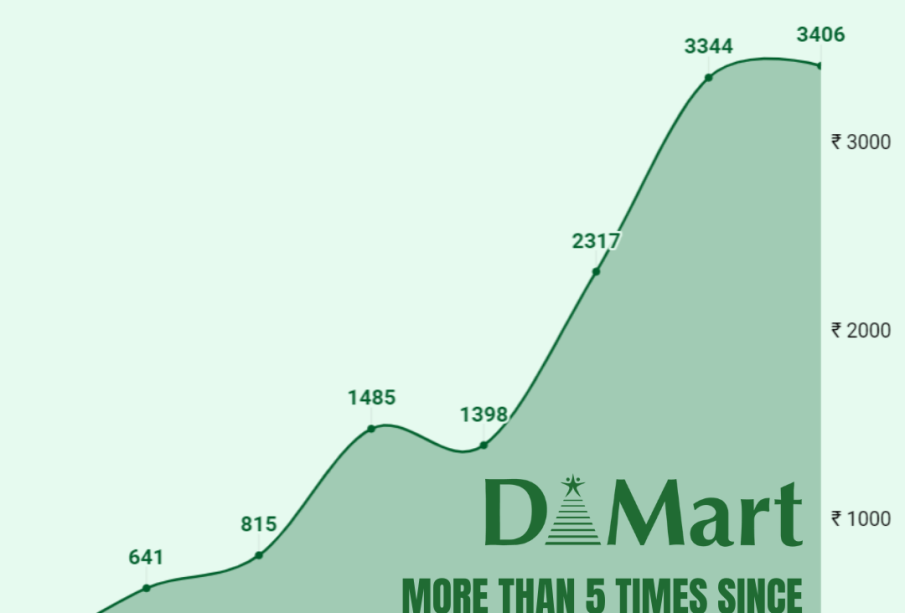

As of the latest reports, DMart’s share price is valued at approximately ₹3600. This marks a steady increase compared to previous months, reflecting the company’s robust business model and recovery post-pandemic. The stock has seen a positive trend, with a year-to-date increase of about 12%. Factors such as rising consumer demand and expansion into new markets are encouraging investor confidence.

Market Analysis

Several analysts have weighed in on DMart’s share performance. Despite some market volatility due to global economic factors, DMart remains a strong player in the Indian retail market. The company’s ability to maintain low prices and a vast selection of products continues to drive foot traffic to its stores. Moreover, DMart has been focusing on increasing its online presence, which is expected to significantly contribute to growth moving forward.

Investment firm XYZ Securities has rated DMart as a ‘Buy’, citing its effective cost management and scalability as key strengths, suggesting that interested investors might see good returns in the medium to long term.

Future Projections

Looking ahead, DMart’s share price is likely to reflect its ongoing expansion strategy, as it aims to open more stores nationwide. The company’s aggressive plans to enhance its supply chain and digital presence may elevate its market standing further. Analysts project that if DMart continues on this trajectory, the share price could reach around ₹4000 within the next year.

Conclusion

The DMart share price is not just a number; it is a reflection of consumer confidence and market trends. For investors, understanding what drives this price and keeping an eye on overall market dynamics could provide significant advantages. With its steady growth and strategic expansions, DMart is poised to remain a preferred choice for investors looking into the retail sector. Continuous monitoring of share price movements and market indicators will be essential for making informed investment decisions.