Current Trends in DMart Share Price

Introduction

DMart, officially known as Avenue Supermarts Ltd., is a leading player in the Indian retail sector, renowned for its competitive pricing and extensive product range. With the ongoing developments in the stock market, the share price of DMart has become a focal point for investors and analysts alike. Understanding the trends and current dynamics surrounding DMart’s share price is crucial for making informed investment decisions.

Recent Market Performance

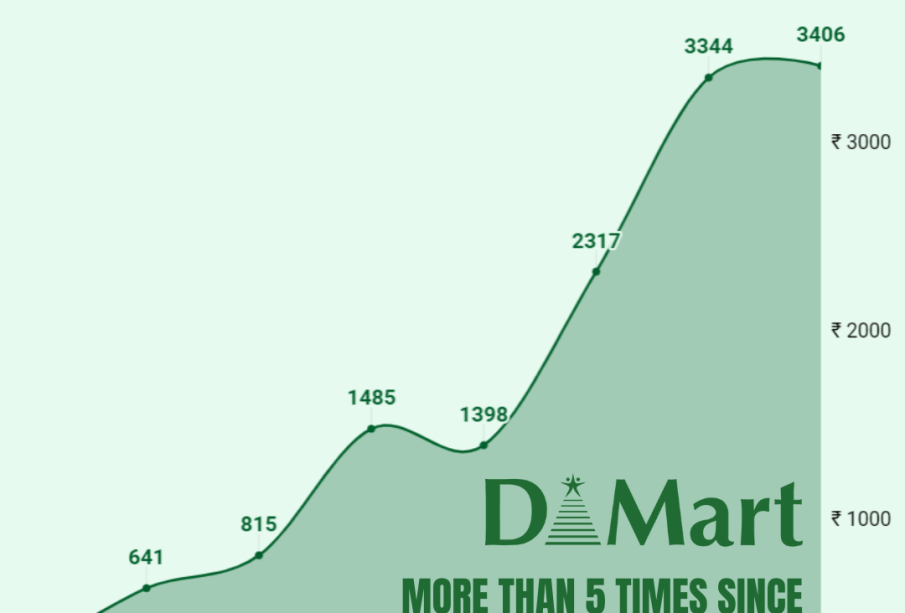

As of early October 2023, DMart’s share price is reflecting varied investor sentiment, currently trading around INR 3,000 per share. Since the beginning of the fiscal year 2023-24, DMart has shown resilience, bouncing back from a dip due to economic pressures from inflation. Analysts have attributed this recovery to solid consumer demand and strategic expansion plans initiated by the company.

The recent quarterly results showcased a robust growth in revenue, surpassing market expectations, which has positively influenced the share price. DMart reported a 25% increase in revenue compared to the same quarter last year, driven by increased footfall in stores and a growing online presence. Furthermore, the company has announced plans to open 20 new stores in the next quarter, bolstering investor confidence.

Factors Influencing Share Price

Several key factors are influencing DMart’s share price. Firstly, the overall economic environment plays a significant role. A stable economic outlook combined with increased consumer spending power tends to favor retail stocks. Secondly, DMart’s effective cost management strategies have allowed it to maintain competitive pricing, a critical aspect of its business model.

Moreover, analysts have pointed towards macroeconomic elements such as inflation rates and consumer behavior trends. With inflationary pressures easing, consumer sentiment has improved, which is likely to reflect positively on DMart’s sales and, consequently, its share price. Additionally, any changes in government policies affecting the retail sector could also pose risks or opportunities for DMart’s stock value.

Conclusion

In conclusion, DMart’s share price is currently navigating through a landscape shaped by both internal operational success and external economic conditions. The overall outlook remains positive, with forecasts suggesting that continued growth in revenue and strategic expansion could further boost the share price in the coming months. For investors, keeping a close eye on quarterly results and broader economic indicators will be essential in assessing DMart’s stock performance moving forward. As more investors consider entering this robust market, DMart’s established position within the retail space makes it a noteworthy consideration.