Current Trends in DMart Share Price

Introduction

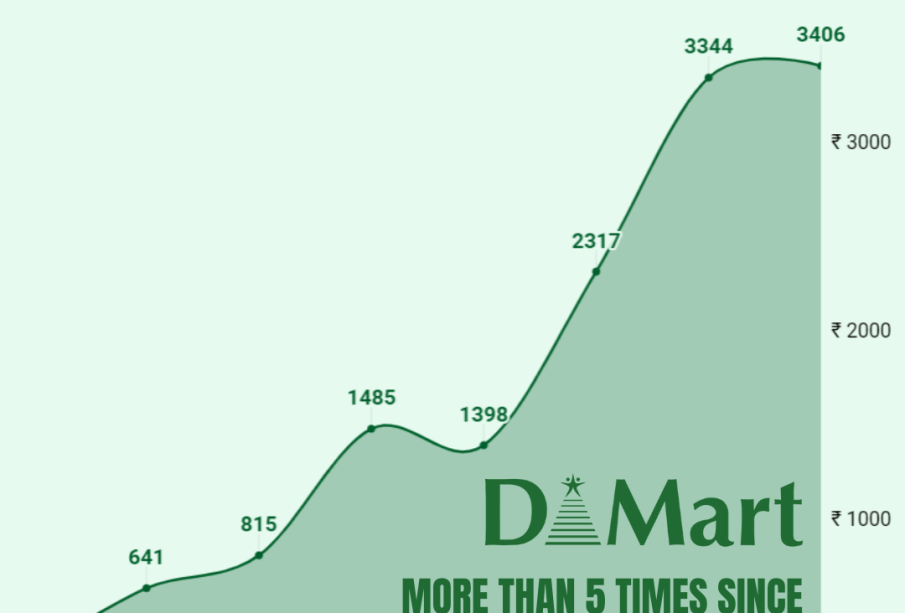

The share price of DMart, officially known as Avenue Supermarts Ltd, is a key indicator in India’s retail sector and is sought after by both investors and market analysts. With the increasing demand for organized retail and changes in consumer behavior, DMart’s performance on the stock market is closely watched. As of late October 2023, the DMart share price reflects both the company’s robust growth strategies and the broader economic conditions affecting retail.

Current Market Performance

As of October 27, 2023, the DMart share price is trading at approximately ₹4,200, having shown a fluctuation of over 5% in the past month. Analysts attribute this recent volatility to several factors, including quarterly earnings results, changes in consumer spending patterns, and global economic pressures such as inflation and supply chain disruptions. The company reported a year-on-year revenue growth of 15% in its recent earnings call, which has contributed positively to its share performance.

Factors Influencing DMart’s Share Price

Investors are particularly focused on the following factors that can impact DMart share price:

- Expansion Plans: DMart has been aggressive in expanding its footprint across India, with plans to open over 100 new stores annually. This expansion is seen as a significant driver for future revenue growth.

- E-commerce Growth: With the growing trend towards online shopping, DMart’s investments in enhancing its e-commerce capabilities are anticipated to attract more customers, thus impacting stock performance positively.

- Market Comparisons: The retail segment is highly competitive in India, with competitors like Reliance Retail and Big Bazaar. DMart’s strategies and market share compared to these players are essential in influencing investor sentiment.

Conclusion

With its consistent growth trajectory and strategic market positioning, DMart’s share price remains a topic of significant interest among investors. As the retail sector adapts to changing consumer preferences and economic conditions, DMart’s ability to maintain its competitive edge will likely shape its future performance on the stock market. Investors are advised to stay informed about the company’s quarterly results and economic indicators that could affect the retail landscape. The outlook for DMart remains cautiously optimistic, with many industry analysts viewing it as a stable long-term investment.