Current Trends in DLF Share Price

Importance of Tracking DLF Share Price

DLF Limited, one of India’s leading real estate developers, has been a significant player in the market, making its share price an essential topic for investors. Understanding the dynamics behind DLF’s share price is crucial not only for stock market stakeholders but also for those interested in real estate trends and economic factors affecting the industry.

Recent Developments

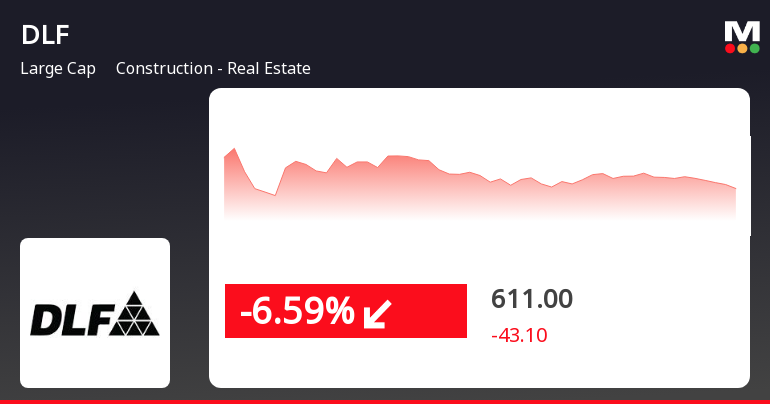

As of October 2023, DLF’s share price has shown considerable fluctuations in the stock market. Recently, the stock experienced a notable rise after the company unveiled its ambitious expansion plans, which include launching several new residential and commercial projects across major cities in India. Analysts have positive forecasts for DLF based on its strategic initiatives and robust financial performance in the last quarter.

The stock was trading around ₹450 per share last week, buoyed by strong quarterly earnings that surpassed market expectations. DLF reported a 15% increase in revenue compared to the previous year, highlighting a strong demand for its luxury residential projects in urban areas. This performance is indicative of a recovering real estate sector in India, which has been rebounding post-pandemic.

Market Sentiments

Investor sentiment around DLF has been largely optimistic, supported by the anticipated rebound in real estate due to improved demand arising from economic recovery. However, some analysts warn about potential volatility in the stock price due to external factors such as fluctuating interest rates and changes in government policies regarding real estate.

Moreover, the overall stock market sentiment also plays a role in DLF’s performance. The NIFTY 50, which includes DLF, has been experiencing ups and downs in recent weeks, but many believe that DLF could outperform its peers due to its solid fundamentals and growth strategy.

Future Outlook

Looking ahead, analysts predict that DLF’s share price may continue to rise, especially if the company can deliver on its expansion plans and maintain its profitability. Investors are advised to keep an eye on upcoming quarterly results, government policies that may affect real estate, and changes in market conditions. Given its historical performance and current strategies, DLF remains a stock to watch in the upcoming months.

Conclusion

In summary, DLF’s share price is not just a number; it reflects the company’s performance, market conditions, and investor sentiment. As DLF continues to expand and adapt to market changes, its share price will be of pivotal interest to both current investors and those considering investment in the real estate sector.