Current Trends in Cummins India Share Price

Introduction

The share price of Cummins India, a leading manufacturer of engines and power generation products, is a critical indicator of its performance in the Indian stock market. Understanding its fluctuations not only benefits investors but also reflects the broader economic trends and the company’s operational efficiency. With recent developments in the engine and energy sectors, analyzing the current share price movements of Cummins India becomes essential for stakeholders.

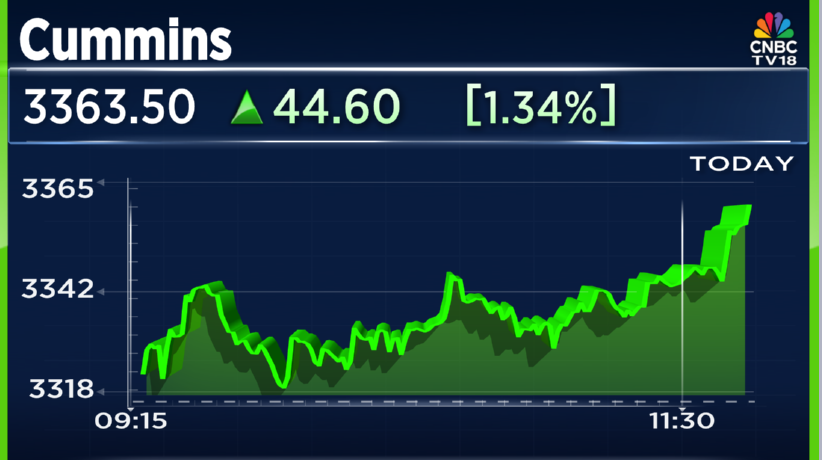

Recent Performance

As of October 2023, Cummins India shares have shown notable volatility, mirroring the larger trends seen across the Indian stock market. The company’s share price reached an all-time high in late September 2023, closing at ₹1,434 per share, following strong quarterly earnings reports that exceeded analysts’ expectations. The 20% increase in revenue year-on-year has been attributed to a robust demand for power generation equipment arising from industrial recovery post-pandemic.

Key Factors Influencing Share Price

Several factors influence the Cummins India share price:

- Market Trends: With the Indian government’s increased focus on infrastructure development, demand for Cummins’ products has surged, consequently impacting stock performance.

- Global Supply Chain: Challenges in global supply chains and rising raw material costs have affected production timelines, leading to stock price adjustments.

- Technological Advancements: Innovations in cleaner energy solutions contribute positively to Cummins’ market reputation, affecting investor sentiment.

- Investor Confidence: Institutional investor activities and market speculation play a significant role, particularly after significant shifts in financial results.

Market Response and Future Outlook

Currently, market analysts project moderate growth for Cummins India, emphasizing the company’s strategic moves towards sustainability and digital transformation. As the automotive and energy sectors are increasingly leaning towards green technology, Cummins’ investments in research and development could further elevate its market position.

Conclusion

Keeping a close eye on Cummins India’s share price is crucial for investors and industry observers alike. The recent performance influenced by both internal strategies and external economic factors highlights the company’s role in shaping India’s industrial landscape. Stakeholders are encouraged to adopt a long-term perspective, as the fundamentals of Cummins India showcase strength and resilience amid evolving market conditions.