Current Trends in CDSL Share Price

Introduction

Central Depository Services Limited (CDSL) has emerged as a pivotal player in India’s financial landscape since its establishment in 2000. With the digitalization of trading and investment, the importance of understanding the share price dynamics of CDSL has never been more relevant. Investors, analysts, and financial enthusiasts are keenly observing the fluctuations in CDSL’s share price as it reflects broader market sentiments and the company’s performance.

Latest Developments in CDSL Share Price

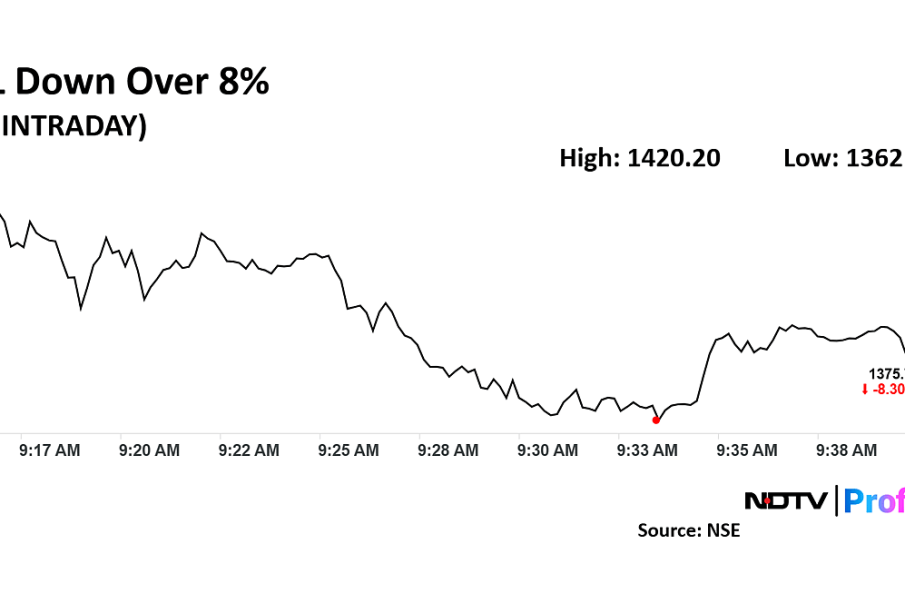

As of October 2023, CDSL’s share price has shown notable resilience amidst the volatile stock market conditions. Currently, CDSL shares are trading at approximately ₹1,070, having experienced an increase of around 5% in the last month. Analysts attribute this upward trend to several factors including stronger-than-expected quarterly earnings, an overall bullish sentiment in the stock market, and heightened activity in the capital markets.

The Company recently reported a 20% increase in net profit for the last quarter, driven by rising fees from dematerialization and other services. This has garnered positive attention from investors and market analysts, leading to increased buying pressure on the stock. Furthermore, the introduction of new financial products and services by CDSL has also contributed to enhancing its value in the eyes of shareholders.

Market Position and Competitiveness

CDSL is one of the two depositories in India, competing directly with National Securities Depository Limited (NSDL). Its strategic initiatives to bolster customer engagement and expand service offerings have positioned it favorably in the industry. The increasing volume of transactions in the securities market further augments CDSL’s growth prospects, indicating that the current share price may continue on an upward trajectory.

Conclusion

In conclusion, CDSL’s share price represents not just the value of the company, but also the growing confidence in India’s financial markets. As the trends in electronic trading and investment continue to evolve, CDSL is likely to experience further growth, making it a stock to watch for potential investors. For those monitoring stock performance, remaining aware of quarterly results and market conditions will be key in making informed investment decisions regarding CDSL shares.