Current Trends in BSE Ltd Share Price

Introduction

The share price of BSE Ltd, the premier stock exchange in India, holds significant relevance for investors and market analysts alike. BSE Ltd is not just a trading platform but a barometer of the country’s economic health. Understanding the factors that influence its share price helps investors make informed decisions.

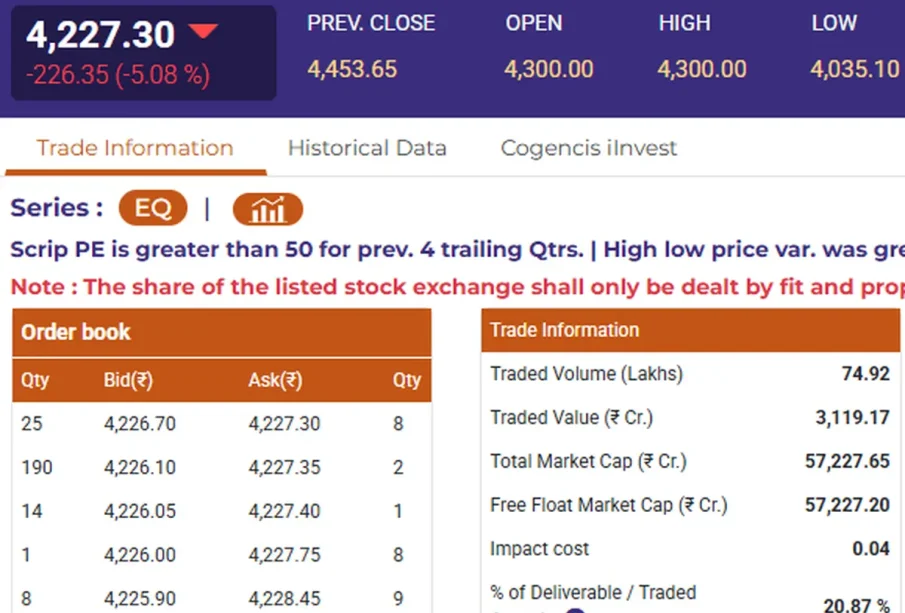

Current Share Price Overview

As of October 2023, BSE Ltd’s share price has been experiencing notable fluctuations. After a steady increase in the first half of the year, the share price faced volatility in recent months due to various market conditions. Currently, the share price hovers around INR 650, reflecting a decrease of approximately 5% from last month’s peak. This decline can be attributed to numerous factors, including global economic instability and changes in investor sentiment.

Market Influences and Analysis

Several key factors have contributed to the recent movements in BSE Ltd’s share price. Firstly, macroeconomic indices such as inflation rates and interest rate decisions by the Reserve Bank of India play vital roles. Recently, the RBI held its interest rates steady, which has had a mixed impact on market performance.

Additionally, corporate earnings reports from companies listed on the BSE have influenced investor confidence. Positive earnings in sectors like technology and pharmaceuticals have provided some support, while sectors rebounding from post-pandemic challenges have created uncertainty. Analysts indicate that as more companies report their quarterly figures, this could lead to further adjustments in share prices across the exchange.

Future Outlook

Looking forward, analysts predict that BSE Ltd’s share price will likely continue to experience volatility as external economic factors come into play. Investors are advised to watch for global market trends, changes in domestic policies, and ongoing corporate performance disclosures. Analysts suggest that if the exchange can maintain its current operational momentum and adapt to economic shifts, it could provide a stable investment opportunity for the long-term. The exchange’s resources in technology advancements and digital trading platforms are also expected to play a crucial role in enhancing its value.

Conclusion

In conclusion, the BSE Ltd share price is a crucial metric for investors looking to gauge the market’s pulse. While current trends show potential instability, the underlying fundamentals of the exchange and the Indian economy provide a platform for possible growth. Investors should remain vigilant and up-to-date with market conditions to make well-informed decisions regarding their investments in BSE Ltd shares.