Current Trends in Broadcom Share Price: An Overview

Introduction

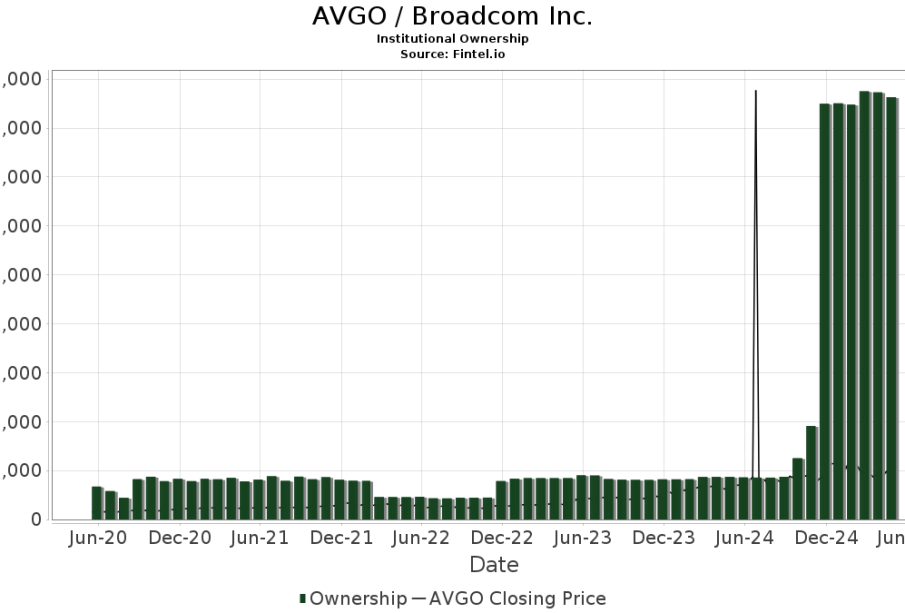

The share price of Broadcom Inc., a leading semiconductor and infrastructure software company, plays a crucial role in understanding the tech sector’s performance. As investors closely watch market trends, the movements in Broadcom’s share price reflect broader economic indicators and investor sentiment regarding technology stocks. Currently, with the tech industry experiencing fluctuations due to various macroeconomic factors, analyzing Broadcom’s price trajectory is essential for prospective investors and market analysts.

Recent Trends and Market Performance

As of October 2023, Broadcom shares are trading around $800, reflecting a robust performance driven by strong earnings reports and positive market reactions to its recent acquisitions and product launches. Over the past quarter, the stock price saw a surge of approximately 15%, supported by increased demand for semiconductors in various industries, including automotive and consumer electronics. The company’s commitment to innovation and expansion into 5G technology has fueled investor confidence, allowing the share price to maintain stability amidst market volatility.

Factors Influencing Share Price

Several factors play a critical role in determining Broadcom’s share price:

- Earnings Reports: Broadcom’s most recent quarterly earnings report exceeded analysts’ expectations, with a significant rise in revenue driven by strong demand across various sectors. This positive outlook has bolstered investor confidence.

- Market Conditions: The overall performance of the stock market, particularly within the technology sector, has a direct impact on Broadcom’s share prices. Current trends indicate a bullish market, contributing to an upward movement in stock prices for tech firms.

- Geopolitical Factors: Global events, including trade relations and geopolitical tensions, can influence investor sentiment dramatically. Broadcom’s exposure to international markets makes it vulnerable to such shifts.

- Technological Advancements: Investments in research and development, particularly in 5G and cloud computing technologies, position Broadcom favorably for future growth, which, in return, reflects positively on its share price.

Conclusion

In conclusion, the current state of Broadcom share price highlights its significance in the broader technology market landscape. With a promising outlook driven by strong earnings, innovative advancements, and favorable market conditions, the stock presents an intriguing opportunity for investors. However, potential investors should remain vigilant regarding external factors that may impact the price. As the technology sector continues to evolve, staying informed about Broadcom’s performance and market trends will be key to making sound investment decisions.