Current Trends in Boeing Share Price

Introduction

The Boeing Company, a leading aerospace manufacturer and defense contractor, has seen its share price experience significant fluctuations in recent months. Understanding the movements in Boeing’s share price is crucial for investors and analysts as it reflects not only the company’s financial health but also the broader trends within the aerospace industry and the economy at large.

Recent Developments

As of mid-October 2023, the Boeing share price has been on an upward trajectory, closing at approximately $220 per share, up from around $190 at the beginning of the month. This rally can be attributed to several key factors, including the recent delivery of aircraft that had been delayed due to supply chain issues and production challenges.

Additionally, positive quarterly earnings reports have bolstered investor confidence. Boeing reported a net income of $1.5 billion for Q3 2023, exceeding analysts’ forecasts. The increased demand for air travel as global restrictions ease further reinforced its recovery. Furthermore, the aviation industry is witnessing a revival, with airlines placing substantial orders for new aircraft, positively impacting Boeing’s long-term outlook.

Market Analysis

According to market analysts, Boeing’s share price is likely to remain volatile in the near future, influenced by supply chain dynamics, competition from Airbus, and ongoing geopolitical tensions that could affect international air travel. Analysts predict the price could range between $210 and $230 in the coming weeks, depending on upcoming earnings releases and new contracts.

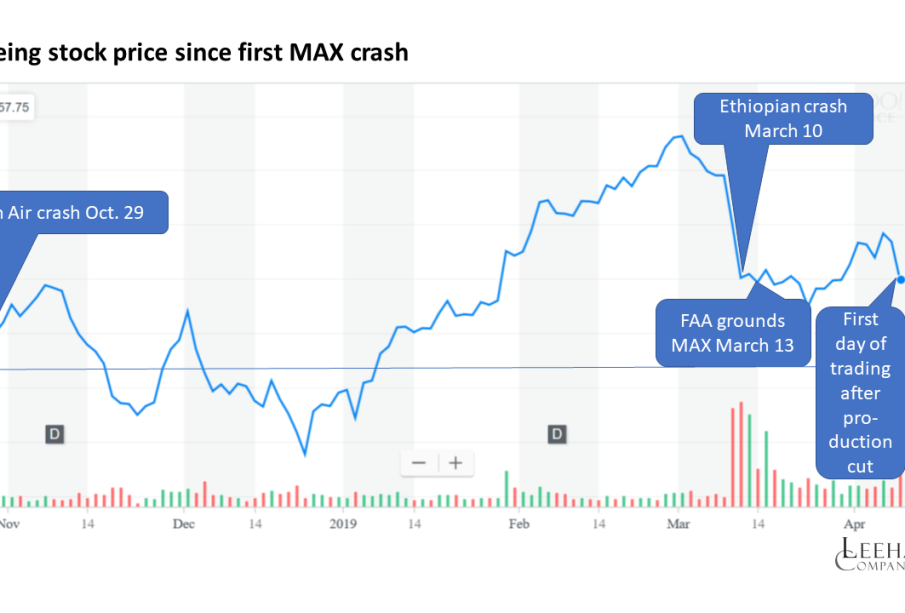

Moreover, investors are closely monitoring Boeing’s operational efficiency improvements and its efforts to ramp up production, particularly of its 737 MAX and the long-awaited 777X models. Experts believe that a successful execution of these strategies will significantly contribute to stabilizing and potentially increasing the Boeing share price.

Conclusion

The Boeing share price is a reflection not only of the company’s operational status but also of broader trends in the aviation market. With positive forecasts and ongoing recovery from the pandemic’s impact, investors remain cautiously optimistic. However, it is essential to stay informed about market developments and company announcements, as these will play a critical role in shaping the future of Boeing’s stock performance. As Boeing continues to adapt and grow, its share price movements will undoubtedly be a focal point for investors seeking opportunities in the aerospace sector.