Current Trends in BLS Share Price

Importance of BLS Share Price

In the ever-evolving landscape of the Indian stock market, the performance of various shares reflects not only company health but also investor sentiment and economic conditions. BLS International, a recognized player in the global outsourcing and visa services sector, has recently gained attention due to notable fluctuations in its share price.

Recent Performance and Market Trends

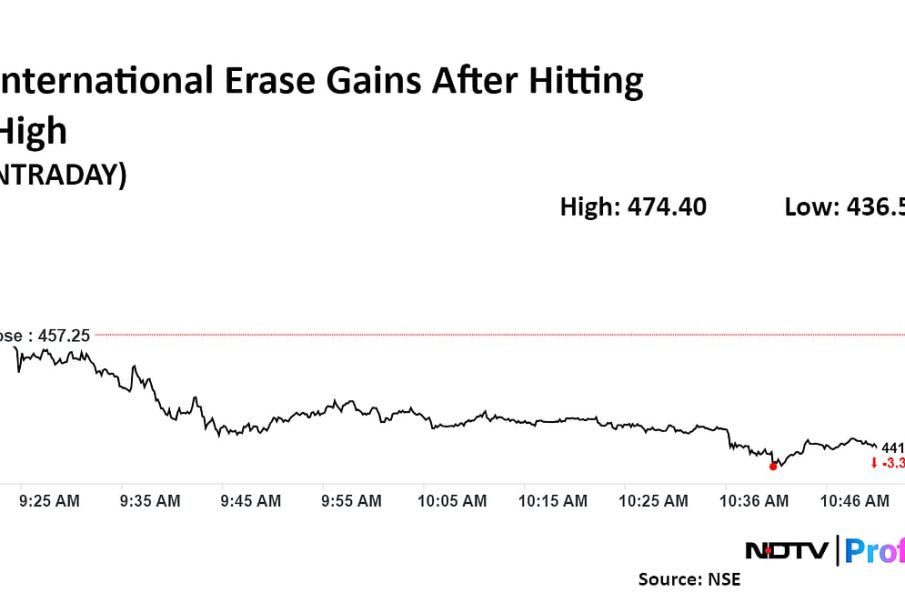

As of October 2023, BLS share price has witnessed significant movement, opening at around ₹350 and hitting a peak of ₹400 in the past month. Analysts attribute this surge to a combination of increasing demand for visa processing amid recovering global travel and favorable policy frameworks being introduced by the Indian government. Additionally, the company has announced several strategic partnerships, enhancing its service offerings and optimizing revenue potential, which have contributed positively to investor confidence.

Despite these positive trends, market analysts remain cautious. The share price has historically demonstrated volatility, often responding to broader economic indicators and changes in travel regulations due to the ongoing effects of the COVID-19 pandemic. This aspect makes BLS share price a topic of considerable interest for both short-term and long-term investors.

Future Outlook

Looking towards the future, experts forecast a steady growth trajectory for BLS International. Factors such as increased travel demand, expansion of their service portfolio, and continuous investment in technology are expected to bolster the company’s market presence. However, potential risks remain, including economic unpredictability and competitive pressures that could affect the company’s profitability and, consequently, its share price.

Conclusion

The performance of BLS share price is a crucial indicator not only for the company’s future but also for investor strategies in a recovering market. As stakeholders keep a close watch on BLS International’s moves, it is clear that both opportunities and risks lie ahead. Investors are encouraged to perform due diligence and stay updated with market trends to navigate their investment decisions effectively.