Current Trends in Biocon Share Price: An Overview

Introduction

Biocon Limited, a biopharmaceutical company based in India, has been a significant player in the biotechnology sector. As it continues to penetrate global markets and expand its product portfolio, the share price of Biocon remains a focal point for investors and analysts. Understanding its current performance can offer insights into the company’s future and the biotechnology sector’s health. With the current economic climate and evolving market dynamics, tracking Biocon’s share price is crucial for investors.

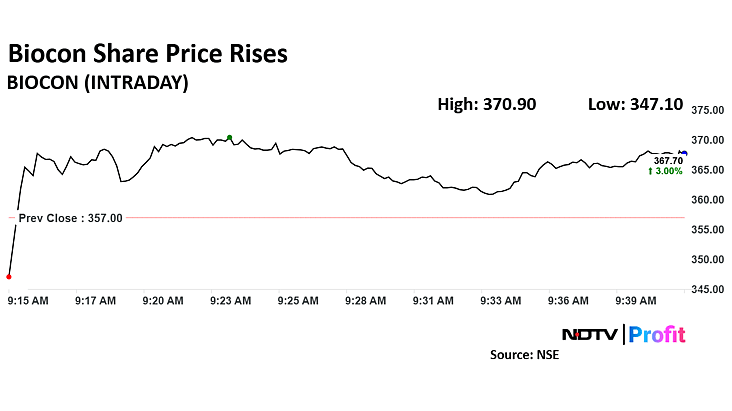

Recent Performance

As of October 2023, Biocon’s share price has experienced fluctuations influenced by various factors, including earnings reports, regulatory approvals, and market sentiment. The stock has seen a range between ₹360 and ₹420 over the last month, amidst larger movements in the Nifty and Sensex indices. Analysts point to the company’s recent quarterly earnings as a critical engine behind its stock’s performance, reporting a 15% growth in revenue compared to the previous year, driven predominantly by growth in its biosimilars segment.

Market Factors Influencing Share Price

Several factors have influenced Biocon’s share price in recent months: 1. **Approval of New Drugs:** The company received approvals for several new biosimilars in key markets, enhancing its revenue potential. 2. **International Collaborations:** Biocon’s partnerships with global pharmaceutical leaders have opened new avenues for growth, enhancing investor confidence. 3. **Market Sentiment:** General market sentiment and economic conditions in India also play a role, with fluctuations in foreign investment impacting share prices across the board.

Future Outlook

Looking ahead, analysts remain optimistic about Biocon’s share price, given the company’s strong fundamentals and growth trajectory. The growing demand for biopharmaceuticals, coupled with the company’s ongoing efforts in research and development, positions Biocon favorably within the biotechnology landscape. Industry experts project that if the company continues to innovate and expand its product offerings, the share price could witness an upward trend.

Conclusion

For investors, keeping a close watch on Biocon’s share price is essential, particularly given the rapidly changing market dynamics in the biotechnology sector. With strategic growth initiatives and partnerships in place, Biocon appears poised for a positive trajectory. As the company continues to carve out its niche in the global market, the share price will likely reflect its operational success and broader market conditions.