Current Trends in Biocon Share Price

Introduction

The Biocon share price has become a focal point for investors in the Indian pharmaceutical sector. As one of the leading biopharmaceutical companies in India, Biocon’s performance on the stock market is closely monitored. Recent market fluctuations, competitive dynamics, and strategic business developments have made the company’s share price a relevant topic for both current and prospective investors.

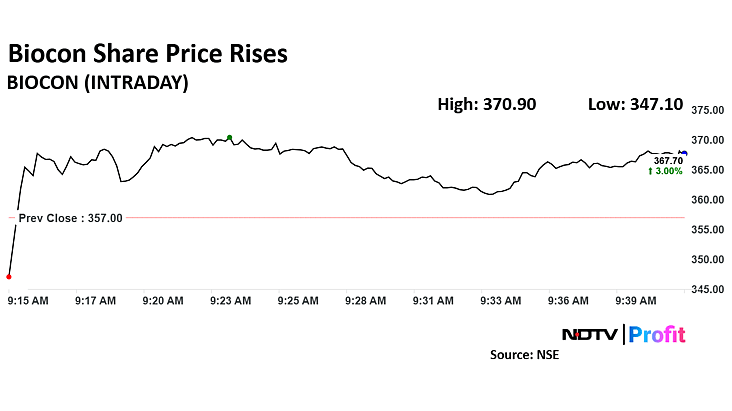

Recent Share Price Trends

As of October 2023, Biocon’s share price has shown a mixed performance. Current trading figures indicate a price of approximately ₹405, which reflects an increase of around 3% over the past month. Analysts attribute this recent rise to positive quarterly earnings that exceeded market expectations, showcasing a year-over-year revenue growth of 15%.

Factors Influencing Biocon’s Share Price

Several factors are driving the fluctuations in Biocon’s stock. Firstly, the increasing demand for affordable biological medicines and biosimilars is enhancing Biocon’s market share. Furthermore, strategic partnerships with global pharmaceutical giants have bolstered investor confidence. Recently, the company announced an alliance with a prominent biologics manufacturer, which is expected to amplify its production capacity and reach international markets.

However, challenges remain, including regulatory hurdles and increasing competition from both domestic and international firms. For instance, the ongoing price controls in India on certain medicinal products can impact profit margins, which is a point of concern for analysts monitoring Biocon’s financial health.

Future Outlook

Looking ahead, industry experts maintain a cautiously optimistic view regarding Biocon’s share price. The company is poised for growth due to its robust pipeline of new products and innovations. Additionally, with increasing investments in research and development, Biocon may enhance its competitive edge in emerging markets. Analysts are projecting a target price of ₹450 to ₹475 over the next six months, contingent upon successful product launches and regulatory approvals.

Conclusion

The evolving landscape of the pharmaceutical sector makes Biocon a significant player to watch. The current share price reflects both the challenges and opportunities faced by the company. Investors should stay informed about market conditions, regulatory updates, and Biocon’s strategic initiatives, as these will undoubtedly impact the future of its share price. As the company navigates through both domestic and international markets, Biocon’s performance will remain a critical barometer for investment decisions in the biopharmaceutical industry.